- EUR/USD managed to rise above 1.1750 ahead of Powell’s speech and core PCE data.

- The dismal US GDP and unemployment claims have provided support to the Euro.

- Powell may act according to the forecast. We may see some clues about tapering.

The EUR/USD price forecast is slightly bullish on Friday as we go through the Jackson Hole, awaiting Powel’ ‘s speech and US Core PCE data.

On Friday, the EUR/USD is trading at 1.1767, up 0.14, ahead of the European session.

–Are you interested to learn more about ECN brokers? Check our detailed guide-

Yesterday, the major currency pair reached a four-day peak near the weekly high due to risk-on sentiment supporting the US dollar. Recent price consolidation has been fueled by mixed headlines from China and New Zealand, as well as doubts about Fed tightening.

The Jackson Hole Annual Symposium will start with a keynote speech from Fed Chairman Jerome Powell. The Fed released its latest statement, which was hawkish and challenged Powell’s monetary policy.

According to US government statistics released Thursday, the US gross domestic product (GDP) for the second quarter was revised to 6.6%, down from 6.5%, and no 6.7% was expected. The main PCE indicators also confirmed the previous consensus market figure of 6.1%. The weekly jobless claims from the US also increased but remained low. Moreover, consumer confidence declined, while the ECB conferences concluded that forward-looking interest rate recommendations should be revised.

What to expect from Jackson Hole by Friday?

The global monetary policy event of the year promises to be an important catalyst for market movement. Although the Federal Reserve System (FRS) and other key players in the global financial sector have clarified their intentions in their forecasts, their intentions remain the same.

As a result, we can get out of the extreme position while preventing an escalation of risk aversion once a buyer of capital leaves the market. The fact remains that we are in the most difficult period of the trading year, regardless of whether these policymakers got away with it. There are still four weeks left before Labor Day (according to the S&P 500), so August is the remainder of the calendar year. In the absence of further major launch signals, complacency can easily hamper these markets.

–Are you interested to learn more about making money in forex? Check our detailed guide-

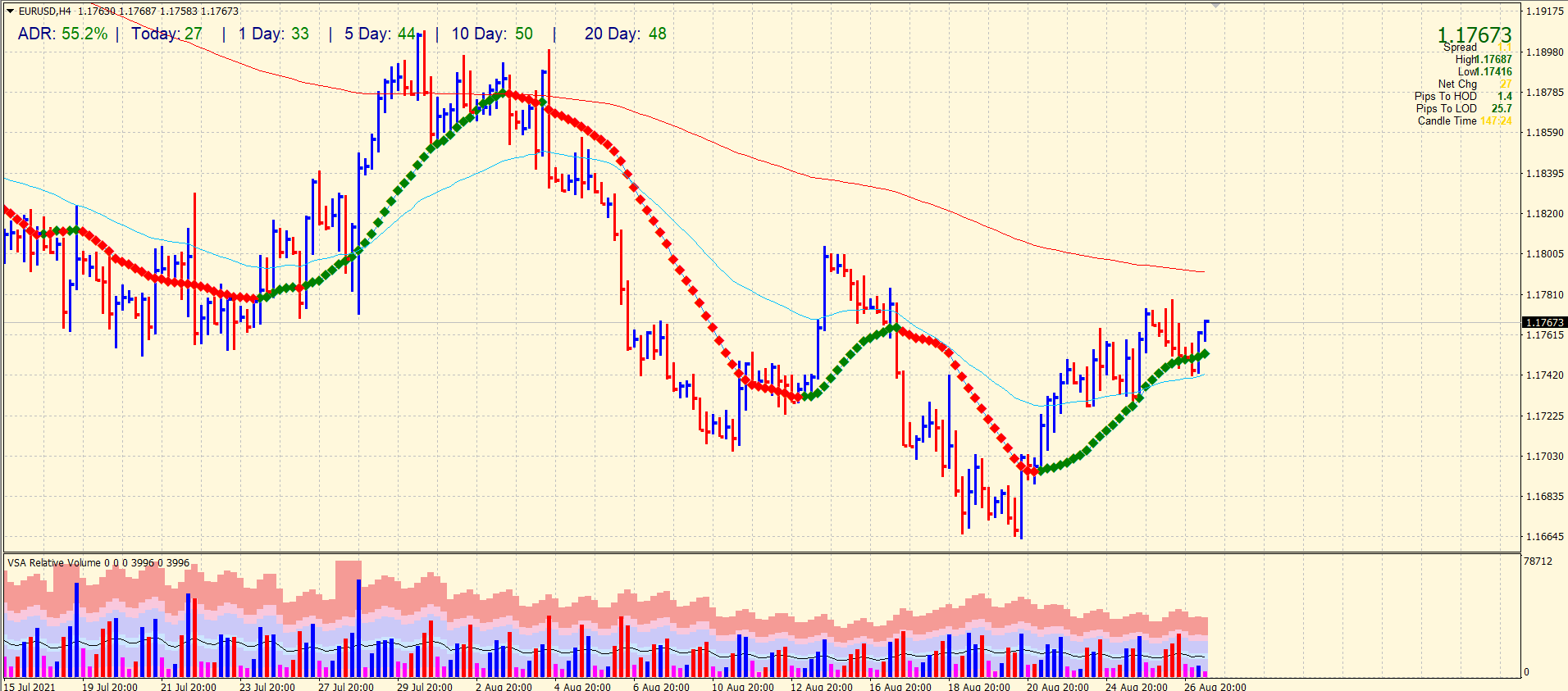

EUR/USD technical forecast: 50-SMA supporting the bids

The EUR/USD price remains supported by the 50-period SMA on the 4-hour chart. The price is also above the 20-period SMA. However, volume is still supporting the bears. It indicates that the upside could be shallow and may find reversal from the local highs of 1.1781. On the downside, 1.1750 is the interim support ahead of 1.1700.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.