EUR/USD broke a long losing streak and recovered from the lows, albeit not closing on the highs. What’s next? The ECB decision is left, right, and center in a busy week in the shadow of frictions around global trade. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

After things calmed down in Italy, the euro got another boost from the ECB. The central bank will debate an exit from the QE program in the upcoming week. This is contrary to a refusal deal with it earlier and it helped the common currency recover. Data during the week was mixed. The US dollar suffered a profit-taking sell-off early in the week and also ignored upbeat data such as the ISM Non-Manufacturing PMI. It then slightly recovered as fear began creeping in. What’s next?

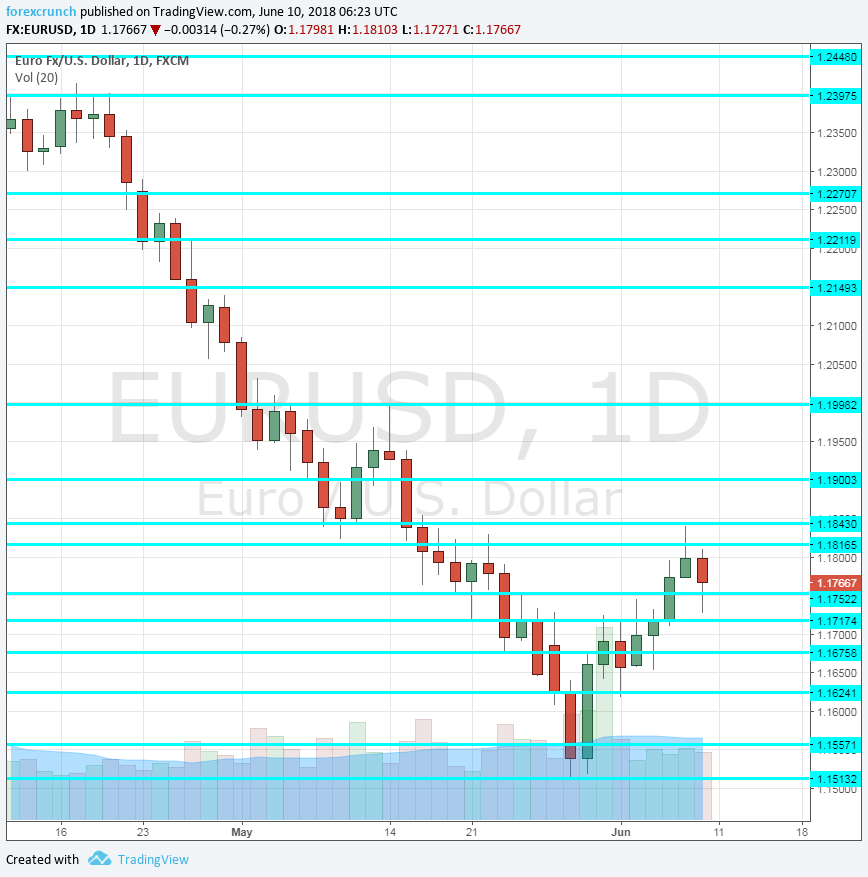

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- French Final Private Payrolls: Tuesday, 5:30. The second-largest economy in the euro-zone enjoyed an expansion of 0.3% in its total workforce in Q1 according to the initial figures. The final read will likely confirm it.

- German ZEW Economic Sentiment: Tuesday, 8:00. Germany’s ZEW institution reported a pessimistic sentiment in the past two months with a score of -8.2 points. For the month of June, this pessimism is forecast to deepen with a fall to -14.6 points. The all-European figure is estimated to have dropped from 2.4 to 0.1 points.

- Employment Change: Wednesday, 9:00. The overall change in employment is not as important as the unemployment rate but still provides a broad, quarterly picture. An increase of 0.3% is on the cards for Q1 2018 after the same scale of rises beforehand.

- Industrial Production: Wednesday, 9:00. The figures for Germany, France, and some other countries are already out, but the all-European measure does not always meet early expectations. After a rise of 0.5% in March, the report for April is expected to show a drop of 0.5%.

- German Final CPI: Thursday, 6:00. Just before the ECB decision, members of the Governing Council will get a reminder of the inflation situation. According to the preliminary release for May, prices rose by 0.5% m/m, fueled mostly by energy. The final read is expected to confirm the initial one.

- French Final CPI: Thursday, 6:45. The second-largest economy also saw prices rise in May, 0.4% in the flash publication. And also here, a confirmation of that read is on the cards.

- Rate decision: Thursday, 11:45, with the press conference at 12:30. Expectations are now much higher than they used to be after reports came out about a live discussion on the next steps in the Quantitative Easing program, a topic the Governing Council refrained from in previous gatherings. The current QE program runs through September and has a pace of 30 billion euros per month. Markets expect further bond buying at the three remaining months of the year, albeit at a slower pace, before purchases come to an end. An initial rate hike is projected for mid-2019. The ECB may indeed announce the reduction and end of bond buying, but the details are somewhat up in the air. A clear commitment to end QE with an end date could boost the euro while a more vague statement about future moves could weigh on it. If Draghi only says that a discussion was held but does not make any announcements, the drop could be sharper. The forecasts for inflation and growth could also have an impact.

- German WPI: Friday, 6:00. The Wholesale Price Index serves as another measure of inflation. Fluctuations at the wholesale level affect the retail one.

- Final CPI: Friday, 9:00. The rise in both headline and core inflation figures in May has improved the mood at the ECB. The final read is expected to confirm the initial read: 1.9% on the headline and 1.1% on the core. Changes are not uncommon.

- Trade balance: Friday, 9:00. The euro-zone enjoys a broad surplus in its trade balance thanks to German exports. The surplus stood at 21.2 billion euros in March and is now forecast to slightly squeeze to 20.2 billion.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar began the week with a move to the 1.1750 level (mentioned last week). After initially stalling at that level, the pair continued to higher ground.

Technical lines from top to bottom:

1.2060 was the low point in late April and it is the last barrier before the round number of 1.20.

The round number of 1.19 is also notable as a pivotal line in the range and it also temporarily held the pair back in late 2017. 1.1845 was the high point in early June.

Further down, the 1.1820 level was a stubborn support line in late 2017. 1.1750 is a low point recorded in mid-May.

1.1720 is a veteran line that worked in both directions, last seen in November. 1.1676 was a temporary low point in late May.

Lower, 1.1630 was a pivotal line in November and 1.1550 was the trough around that time.

Below, 1.1510 is the new 2018 low and also a ten-month trough. Further down, 1.1480 served as support back in July 2017.

I remain bearish on EUR/USD

The worsening relations between the US and the rest of the world around trade are set to take their toll and it is not priced in. While a risk-off atmosphere may not deter the ECB from announcing their exit strategy, but the mood is likely to assist the safe-haven yen and the USD against all the rest. In addition, the Fed is set to raise rates, serving as a reminder of the divergence between the monetary policies on both sides of the Atlantic.

Our latest podcast is titled Truce in trade and dollar domination

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!