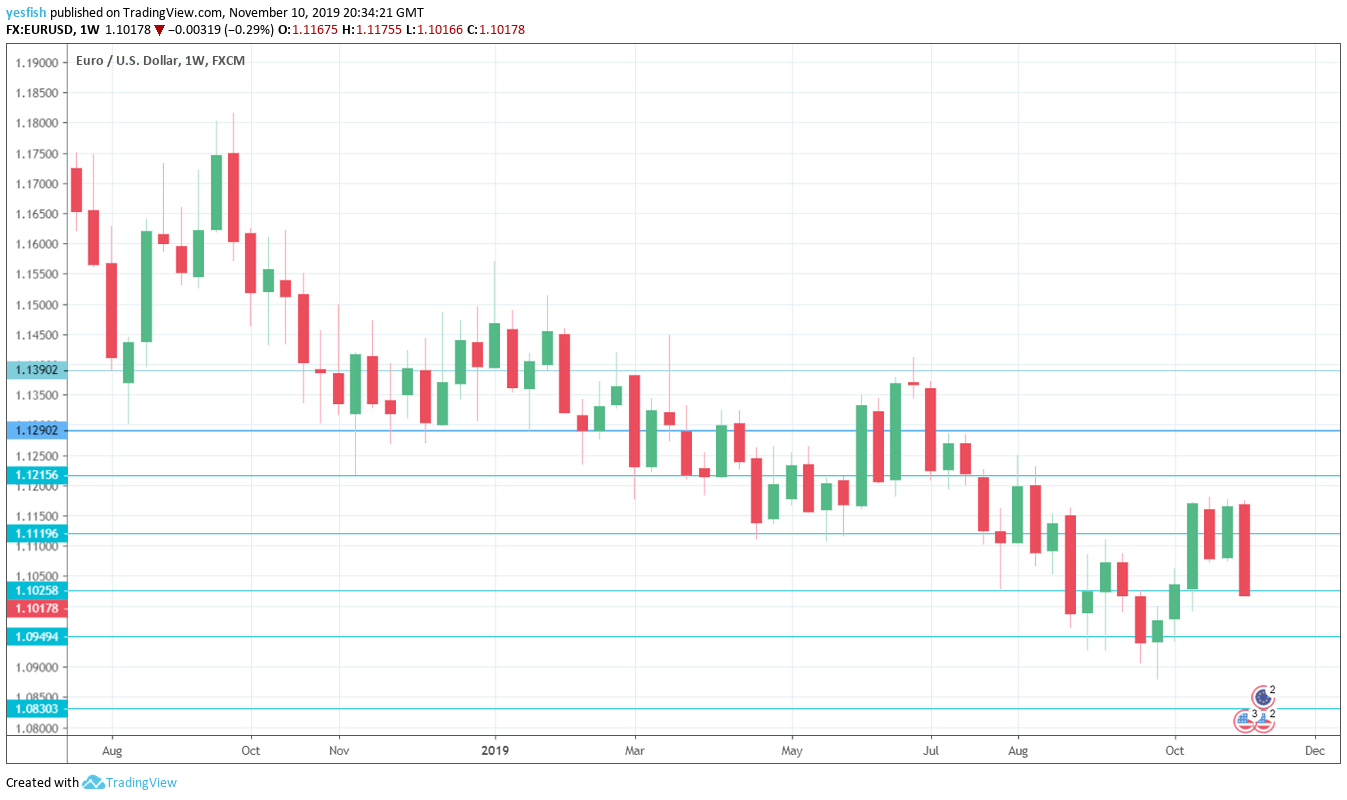

EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- Spanish Parliamentary Election: Sunday, All Day. Spaniards are off to the polls for the second time this year. With no clear front runner, the result could lead to political instability in the eurozone’s fourth-largest economy.

- German ZEW Economic Sentiment: Tuesday, 10:00. This key confidence indicator remains mired in negative territory. The index dipped to -22.5 in October, but is expected to improve to -13.2 in November. The all-eurozone index is also expected to improve to -11.5, up from -23.5 points.

- German Final CPI: Wednesday, 7:00. German inflation remains subdued and is expected to improve to 0.1% ijn October, confirming the initial estimate.

- Eurozone Industrial Production: Wednesday, 10:00. The eurozone manufacturing sector has struggled, with this indicator posting two declines in the past three readings. Another decline is expected in September, with an estimate of -0.2%.

- German Preliminary GDP: Thursday, 7:00. The German locomotive contracted by 0.1% in Q2, and another decline of 0.1% is expected in Q3, which could weigh on the euro.

- Eurozone Flash GDP: Thursday, 10:00. This is the second estimate of GDP, and is expected to remain steady at 0.2% in September. This would confirm the initial estimate back in October.

- Eurozone Final CPI: Friday, 10:00. Eurozone inflation remains low, with the September release projected to drop from 0.8% to 0.7%. This would confirm the initial estimate.

EUR/USD Technical analysis

Technical lines from top to bottom:

1.1390 was a stepping stone on the way up in late January and capped EUR/USD earlier. 1.1345 is next.

1.1290 has held in resistance since the first week of July. 1.1215 is next.

1.1119 (mentioned last week) remains relevant.

1.1025 has switched to a resistance role after sharp losses by EUR/USD last week.

1.0950 is the first support level.

1.0829 has held in support since April 2017.

1.0690 is the final support level for now.

I am neutral on EUR/USD

The euro continues to show strong swings in both directions, making it difficult to establish a trend. The U.S. economy continues to outperform the eurozone, but recent rate cuts by the Federal Reserve has investors looking for alternatives to the U.S. dollar.

Follow us on Sticher or iTunes

Further reading:

-

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week

Safe trading!