EUR/USD enjoyed significant gains as the US Dollar lost ground in a calm atmosphere. What’s next? Fresh inflation figures and Draghi’s testimony stand out in the last week of September. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

The US announced new tariffs on China on $200 billion worth of products, as expected. Markets seemed to take it with a stride. However, the greenback enjoyed the rise in 10-year yields. ECB President Mario Draghi did not rock the boat. August’s inflation numbers were confirmed at 2% on the headline and 1% on the core, just before September’s preliminary numbers.

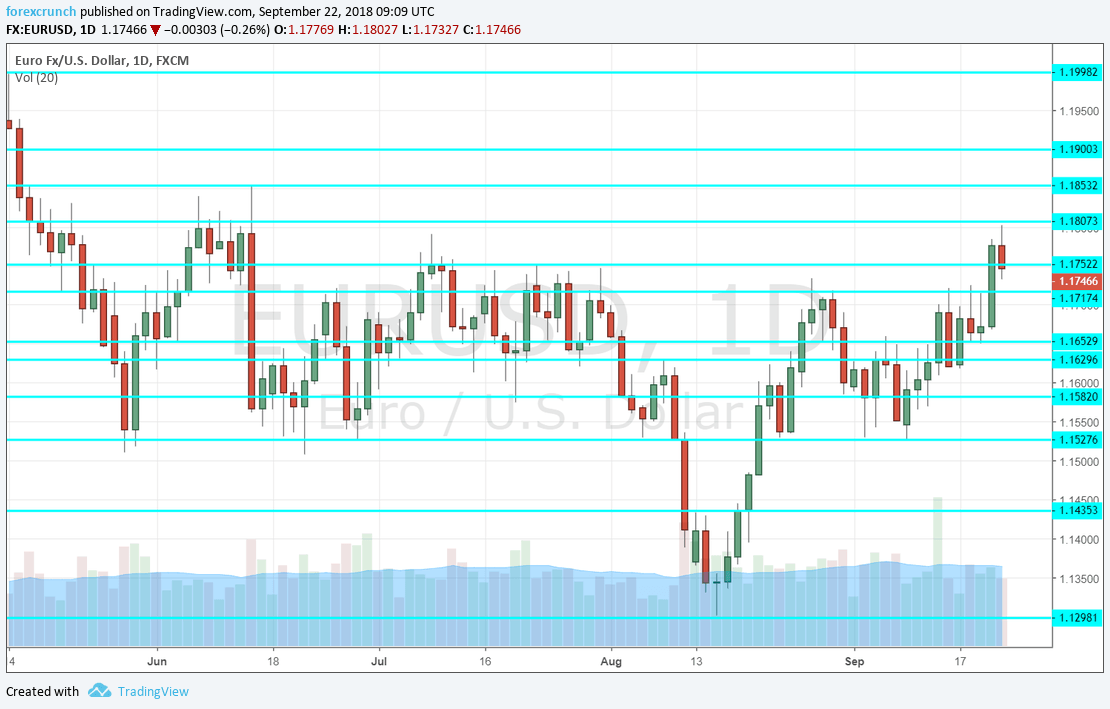

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily chart with support and resistance lines on it. Click to enlarge:

- German Ifo Business Climate: Monday, 8:00. IFO is Germany’s No. 1 think-tank and its broad survey moves the euro. The Business Climate beat expectations in August with a score of 103.8 points, a multi-month high. A drop to 103.2 is projected now.

- Mario Draghi talks Monday, 13:00. The President of the European Central Bank testifies before a committee of the European Parliament in Brussels. He is set to provide fresh insights about the economic situation, inflation developments, and more. As the next rate decision is still far off, he may feel free to hint about monetary policy.

- Belgian NBB Business Climate: Monday, 13:00. This 6000-strong survey advanced to -0.3 in August, almost fully balanced between improving and worsening conditions. A slide to -0.5 is on the cards.

- German GfK Consumer Climate: Thursday, 6:00. This survey is for consumers, not businesses. After peaking early in the year, German consumers are less optimistic in recent months with the score dropping to 10.5 in August. We will now get the figures for September. An increase to 10.6 is on the cards now.

- Monetary data: Thursday, 8:00. The ECB’s M3 Money Supply measures money in circulation and that has decelerated to 4% in July after two quicker months. Private Loans remained steady at 3% y/y in July. The figures for August will likely be similar. Money supply is expected to decelerate to 3.8% and private loans to maintain the same rate of 3%.

- ECB Economic Bulletin: Thursday, 8:00. Two weeks after the rate decision, the European Central Bank releases the economic data they used before making its decision. The publication sheds more light on the thinking at the central bank.

- German Prelim CPI: Thursday, during the morning from the various German states and 12:00 for all of Germany. Germany’s Consumer Price Index rose by only 0.1% m/m in August. The preliminary data for September has a significant impact on the all-European measure published on Friday. Another minor increase of 0.1% is predicted.

- French Consumer Spending: Friday, 6:45. French consumers have been cautious in recent months, with small advances in consumption. An increase of 0.1% was seen in July. The figure for August could be better. An increase of 0.3% is expected.

- French CPI: Friday, 6:45. The second-largest economy in the euro-zone publishes also has a significant impact on the all-European figure. CPI jumped by 0.5% in August after slipping by 0.1% in July. A drop of 0.1% is on the cards.

- German Unemployment Change: Friday, 7:55. Germany’s economic boom is well-reflected in the constant drop in the number of the unemployed. A slide of 8K was seen in July and yet another drop is likely in August. A slide of 9K is estimated.

- Spanish Flash CPI: Friday, 8:00. The fourth-largest economy saw an annual inflation rate of 2.2% in August, above the euro-zone average. Its last-minute input may shape CPI expectations for the continent. Yet another annual increase of 2.2% is projected.

- Inflation: Friday, 9:00. Headline inflation stood at 2% in August, bang on the ECB’s target. However, core CPI disappointed with only 1%. The increase in energy prices made the difference. ECB President Mario Draghi was not very worried about weak core inflation in his last press conference. We will now get the preliminary numbers for September, just as the ECB tapers down its bond-buying scheme. A small uptick to 2.1% on the headline and 1.1% on the core is projected.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar moved up but was somewhat stuck when challenging the 1.1720 level (mentioned last week). It then surged to 1.1800, the highest since July before settling a bit lower.

Technical lines from top to bottom:

1.1915 was the low point in January and remains relevant. 1.1850 was the peak on June 14th, before Draghi sent the euro down. 1.1800 capped the pair in mid-September.

1.1750 held the pair no less than four times in July and remains a powerful level.

1.1720 is a veteran line that worked in both directions and it capped the pair in mid-September. 1.1650 was a swing low in late August and is very closely followed by 1.1630 which held the price down in mid-August.

1.1580 worked as support in late August. 1.1530 supported the pair twice in August, making it an important line. 1.1435 held the EUR/USD down when it was trading around the yearly lows.

1.1300 is a round number that held the pair in mid-August and also held the pair down in June 2017.

I am bearish on EUR/USD

After the correction, the greenback will likely resume its rally thanks to a hawkish Fed decision. Unimpressive euro-zone inflation figures could hurt the common currency.

Our latest podcast is titled Too hot or too cold? The world is watching the Fed

Follow us on Sticher or iTunes

Further reading:

- GBP/USD forecast – Pound/dollar predictions

- USD/JPY forecast – analysis for dollar/yen

- AUD/USD forecast – the outlook for the Aussie dollar.

- USD/CAD forecast – Canadian dollar predictions

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!