- Governments and banks are taking measures to avoid a financial crisis.

- The European Central Bank raised interest rates as planned on Thursday.

- Markets are currently putting in an 80.5% chance that the Fed will raise rates by 25bps.

Today’s EUR/USD outlook is bullish. The dollar fell on Friday as risk sentiment improved. This followed government and bank measures to reduce pressure on the financial system in major markets.

–Are you interested in learning more about making money with forex? Check our detailed guide-

Despite the recent market turmoil, the European Central Bank raised interest rates as planned on Thursday, which caused the dollar to decline and the euro to rise. This indicates that the Federal Reserve will also likely increase rates next week as both institutions work to control inflation.

The two currencies maintained a tight range before the ECB made good on its vow to raise rates by half a percentage point. Markets are currently putting in an 80.5% chance that the Fed will raise by 25bps on March 22.

For the first time in four decades, the Fed and ECB increased interest rates at the fastest pace. A comparatively robust economy and higher interest rates on US government debt than in other nations have strengthened the dollar.

Nevertheless, a panic on international markets following the failure of Silicon Valley Bank in the US last week and a decline in the share price of Credit Suisse this week threatened to derail the ECB’s plans to raise interest rates.

After the ECB’s announcement, the euro initially declined by over 0.25% but eventually turned around.

The currency and other markets were relatively calmer on Thursday. Credit Suisse indicated it would borrow up to $54 billion from the Swiss National Bank to increase liquidity and investor confidence.

EUR/USD key events today

Investors expect a Eurozone inflation report showing whether high-interest rates are cooling price increases in the region.

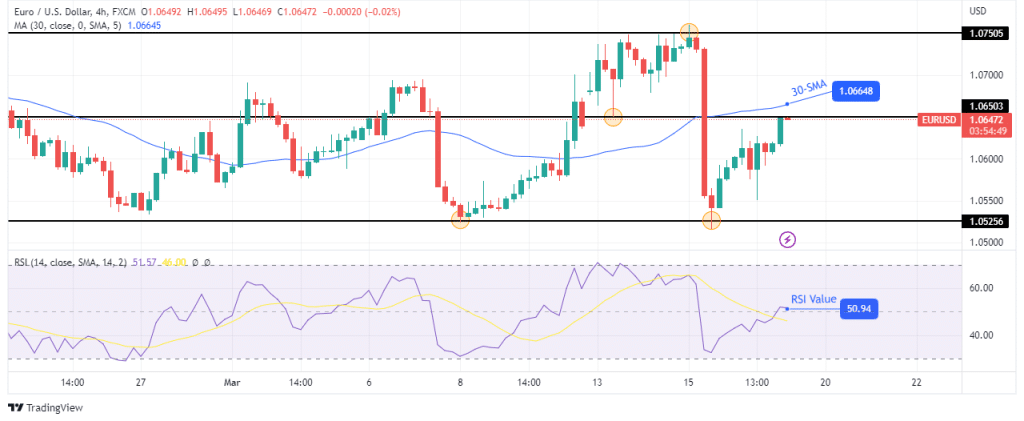

EUR/USD technical outlook: Bullish move might pause at 1.0650 hurdle

The 4-hour chart shows EUR/USD in a bullish move, approaching the 30-SMA resistance. The RSI is trading slightly above 50, showing bulls are gaining strength over bears. However, since the price still trades below the SMA, control lies with the bears.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

Bulls must break above the 1.0650 resistance and the SMA to take over control. Bears will return if the strong resistance zone holds strong and we might see the price falling to the 1.0525 support.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money