- EUR/USD runs higher as US dollar weakness prevails.

- Coronavirus across the globe may hurt the risk sentiment.

- Comments from ECB officials continue to lend support to the pair.

The EUR/USD price has been reclaiming new highs since August 6, rising 0.15% on the day to 1.1815 ahead of Tuesday’s European session. A general weakness in the US dollar ahead of the preliminary Eurozone consumer price index (CPI) is thus welcomed by the pair.

–Are you interested to learn more about ECN brokers? Check our detailed guide-

As market sentiment improves amid a slight consolidation in virus activity, the US dollar index (DXY) falls to a new low in two weeks, no later than 0.11% to 92.59. A low yield on government bonds also affects the dollar and favors the bulls on the EUR/USD pair. At press time, the yield on 10-year US Treasuries had fallen to a weekly low of 1.273%, down 1.1 basis points (bps).

Australia’s daily contagions are regressing, but New Zealand’s coronavirus rate has decreased six days in a row, and the UK’s COVID-19 cases have declined in two weeks, which supports USD sales. The market, however, seems to be challenged by concerns about Eurozone CPI today and NFP data on Friday. In addition to Afghanistan and China’s geopolitical concerns, the EUR/USD pair is expected to enter a bullish trend.

The EUR/USD pair is also being impacted by comments from the European Central Bank (ECB) indicating an expansion of easy money policies. Robert Holtzmann and François Villerois de Galhau, governor of the Bank of France and ECB Councilor, recently dismissed reflation fears. Consequently, today’s block inflation data, which is expected to rise to 1.5% YoY from 0.7% YoY, will be a key factor.

Additionally, if the EUR/USD bulls are buoyed by simple pressure on Eurozone CPI, follow-up measures should include data about Chicago PM, consumer confidence, and real estate in Chicago. But nothing is more important than the August US employment report, which will justify the cautious optimism of Fed chief Jerome Powell and determine the course of Fed cuts going forward.

–Are you interested to learn more about making money in forex? Check our detailed guide-

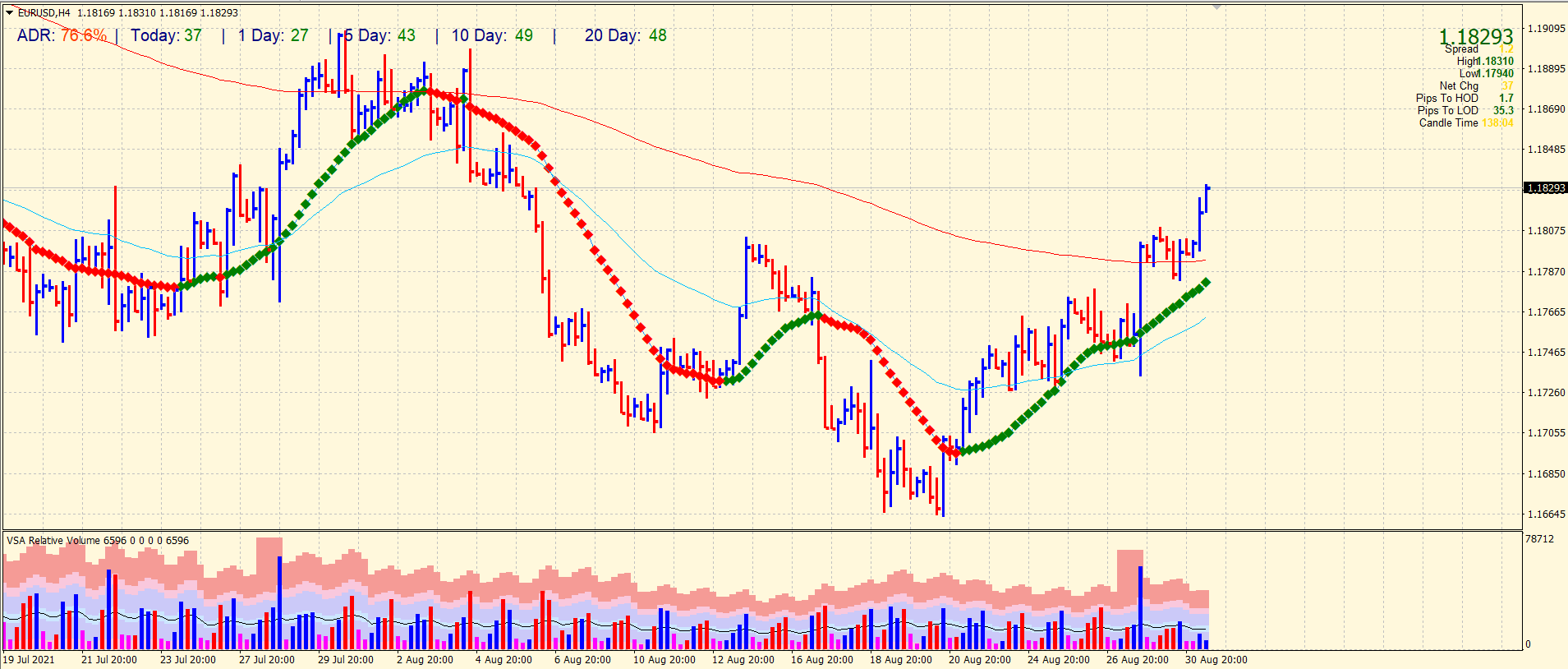

EUR/USD price technical analysis: Bulls aiming higher

The EUR/USD pair is heading higher beyond the 200-period SMA. The pair is looking to test the order block zone at 1.1860s. The next target could be the psychological area of 1.1900. The volume is quite low since Friday’s gains. On the downside, the pair may test 1.1800 ahead of 1.1770 and then 1.1750.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.