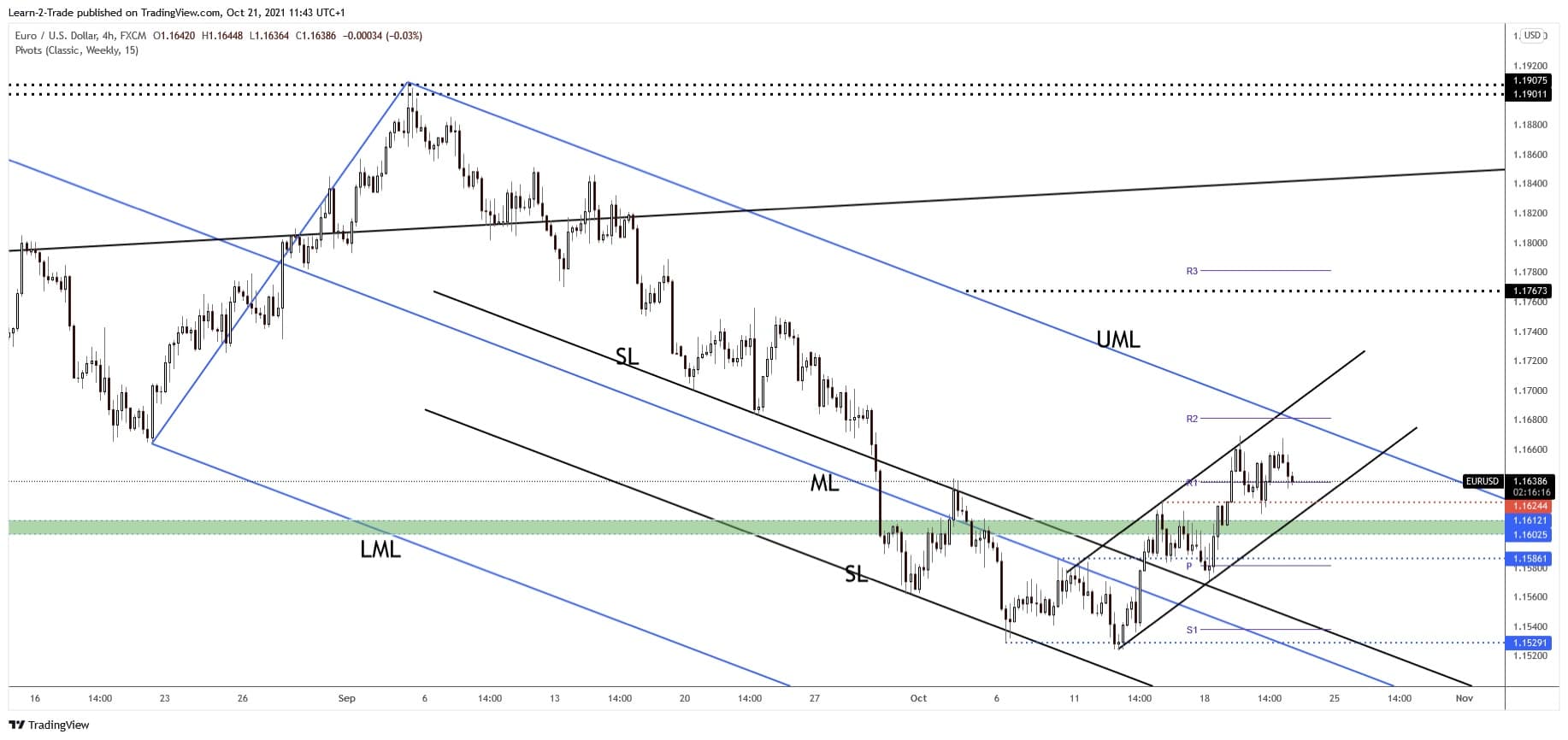

- The EUR/USD pair maintains a bullish bias as long as it stays within an up channel.

- A downside breakout confirms the pattern as a continuation one.

- A larger upwards movement could be validated by a breakout above the upper median line (UML).

The EUR/USD forecast sees the pair trading in the red at 1.1640 level at the time of writing. The price stands within an up channel as the Dollar Index is trapped within a down channel. As long as the DXY drops, the pair is expected to grow.

Technically, the price moves somehow sideways in the short term trying to accumulate more bullish energy before jumping higher. The outlook is bullish, so we can still look for long opportunities.

3 Free Forex Every Week – Full Technical Analysis

The rate seems undecided ahead of the US data dump. The Unemployment Claims indicator is expected to grow from 293K to 298K in the previous week. In addition, the Philly Fed Manufacturing Index could drop from 30.7 to 25.1 points, the Existing Home Sales are expected to grow from 5.88M to 6.10M, while the CB Leading Index may register a 0.4% growth versus a 0.9% growth in the previous reporting period.

You should keep an eye also on the Euro-zone Consumer Confidence which could drop further from -4 points to -5 points. Worse than expected US economic figures could force the Dollar Index to drop deeper, this scenario should push the EUR/USD higher.

If you want to learn about automated forex trading then start by reading our helpful guide.

EUR/USD Forecast: Price Technical Analysis – Up Channel

The EUR/USD pair slipped lower to retest the 1.1637 weekly pivot point. As long as it stays above the 1.1624 level, the price could still approach and reach new highs. The bias is bullish as the rate stands above the immediate uptrend line.

The immediate resistance level is seen at the 1.1669 level. Also, the upper median line (UML) could be used as an upside target, as a dynamic resistance. As you can see on the H4 chart, the EUR/USD is trapped between the 1.1624 and 1.1669 levels.

Escaping from this pattern could bring new opportunities. A valid breakdown from this pattern confirms it as a continuation pattern. This scenario could help us to catch new short movements.

On the other hand, a larger upwards movement will be confirmed by a valid breakout through the upper median line (UML).

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.