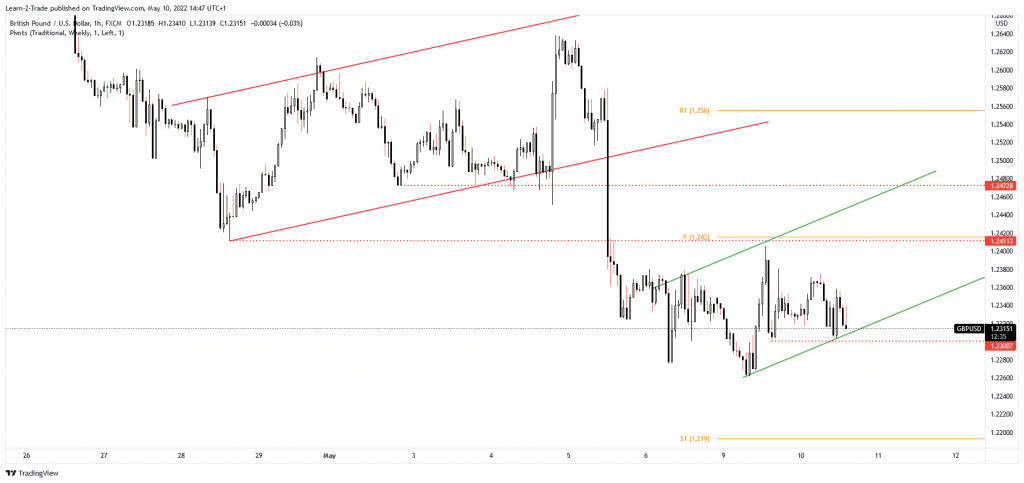

- The GBP/USD pair could extend its sell-off after validating the flag pattern.

- A new lower low could activate a larger downside movement.

- The bias remains bearish despite temporary rebounds.

The GBP/USD price maintains a bearish bias despite temporary rebounds. The pair was trading at 1.2322 at the time of writing, far below 1.2375 today’s high. The 1.2300 psychological level stands as critical support. It is important to watch how it will react when it reaches this level.

–Are you interested in learning more about STP brokers? Check our detailed guide-

The USD remains bullish even if the US Unemployment Rate and the Average Hourly Earnings came in worse than expected on Friday.

The Dollar Index moves somehow sideways around the 103.65 – 103.82 resistance area in the short term. A valid breakout above this zone may signal an upside continuation. This scenario could signal that the USD should appreciate versus its rivals.

Fundamentally, the UK BRC Retail Sales Monitor dropped by 1.7% versus the 3.5% growth expected, while the US NFIB Small Business Index came in better than expected at 93.2 points above 92.9 forecasts. FOMC members Mester, Waller, and Williams’s speeches could bring some volatility.

Tomorrow, the US inflation figures could really shake the markets. The Consumer Price Index is expected to report a 0.2% growth in April, less versus 1.2% in March, while the Core CPI may report a 0.4% growth in the last month versus 0.3% growth in the previous reporting period.

GBP/USD price technical analysis: Uptrend channel

As you can see on the 4-hour chart, the pair developed a new flag pattern representing a downside continuation pattern. In addition, the minor uptrend line and the 1.2300 represent downside obstacles.

–Are you interested in learning more about making money with forex? Check our detailed guide-

So, only a valid breakdown may signal a downside continuation. Dropping and stabilizing under these levels could bring new short opportunities. 1.2380 stands as the first upside obstacle. In the short term, it moves sideways. That’s why it’s important to escape from this range to confirm a strong movement.

In my opinion, the bias remains bearish as long as it stays under the 1.2411 key level. Moreover, the bias remains bearish despite temporary ranges or temporary rebounds. A larger downside movement could be confirmed by a new lower low if the rate drops and closes below 1.2260.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money