- GBP/USD attempts to rise from 1.3870.

- The rise attempts lack follow-through momentum.

- Political and Brexit headlines are keeping pressure on the Pound.

The GBP/USD price has bounced from an eight-day low of around 1.3870 ahead of the London opening on Monday.

During the early Asian session, the cable followed the general trend of the market to reflect the strength of the US dollar. During the same period, Brexit and the UK’s political headlines favored the bears. Due to recent market consolidation, GBP/USD sellers have also gained a little breathing room, casting doubt on bullish US dollar sentiment.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

As markets welcomed the Fed’s easing of concerns over an upbeat US labor report on Friday, the US dollar index (DXY) surged to a new 18-day high. As you know, NFP rose 943,000 in the latest report (revised from 850,000), which also beat market expectations of 870,000. Additionally, June’s unemployment rate dropped from 5.9% to 5.4%.

Nevertheless, US infrastructure spending optimism and fairly straightforward Covid numbers from Australia and the UK are hindering DXY gains.

While political disagreements between UK Prime Minister Boris Johnson and US Treasury Secretary Rishi Sunak have raised concerns over Brexit, Sterling / US dollar sellers have also been upbeat.

A Times report said that Shiv Sunak’s allies warned Boris Johnson that he would not understand their response to reports that he was considering humiliating him if he fired the chancellor. …

According to The Guardian, James Ramsbotham, CEO of the North East Anglia Chamber of Commerce, “A letter to Boris Johnson goes unanswered.” The Brexit Brawl also discusses the recent progress made by the former Brexit Party. British leader Nigel Farage told UK Express: “He urged the European Commission and French President Emmanuel Macron to agree to the summit, or many lives could be lost and communities would suffer.”

By the time of publication, US stock futures remain weak, and the DXY has cut its strong rise in early Asia to 92.80.

The recent headlines about Brexit and UK politics, not to mention renewed US stimulus and easing trade hysteria, maybe entertaining GBP/USD traders in the absence of any key data/events.

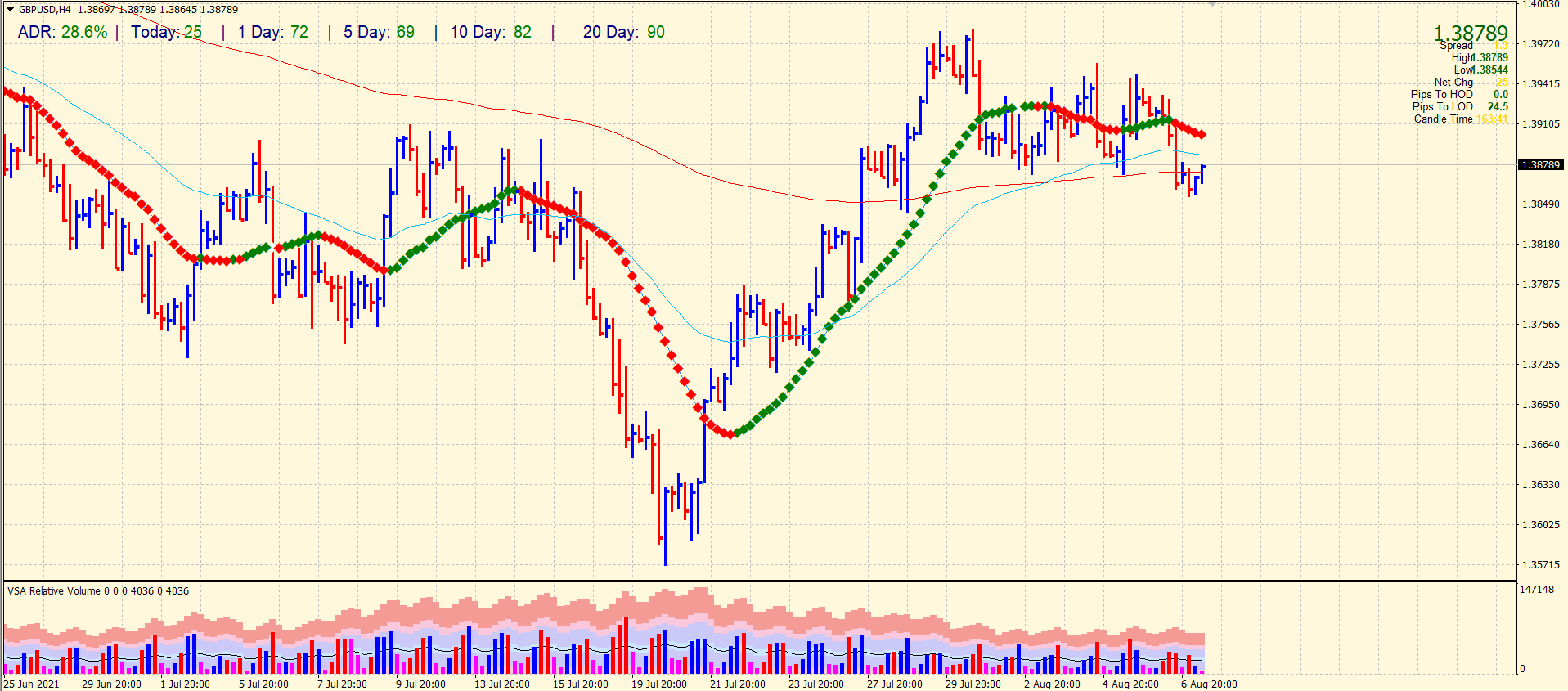

GBP/USD price technical analysis: Neutral to bearish bias around 200-SMA

The GBP/USD pair is wobbling around the 200-period SMA on the 4-hour chart. The 50-period SMA is also pressing down the price. The price bars on Friday came up with heavy selling volume. It means more downside will prevail. Only a move beyond 1.3910 can shed off bearish clouds for the time being.

–Are you interested to learn more about forex signals? Check our detailed guide-

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.