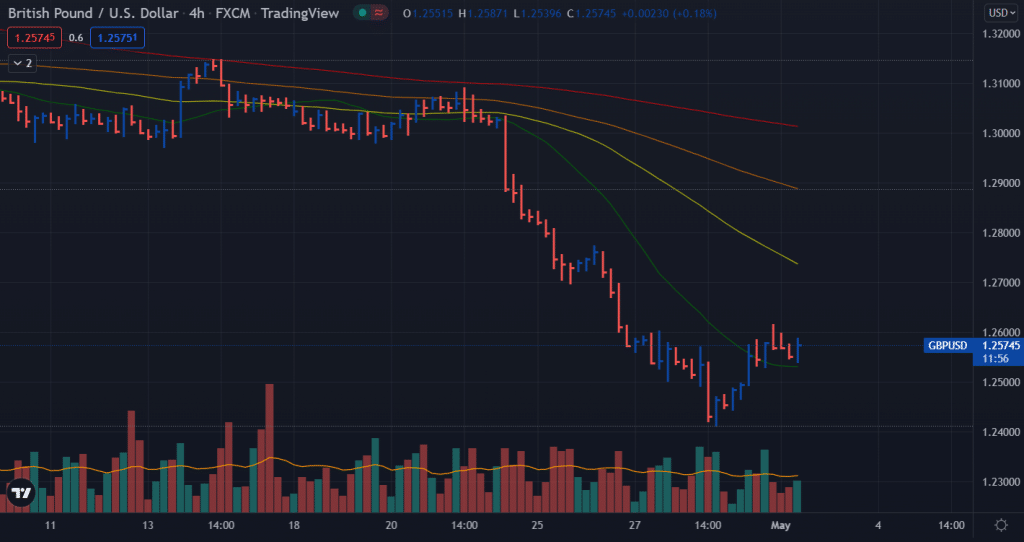

- During the European session, the GBP/USD pair dropped below 1.2600.

- The Fed’s aggressive rate hike comments acted as a headwind for the US dollar.

- The downside remains muted ahead of the key FOMC/BoE monetary policy meetings.

At the start of the European session, the GBP/USD price recovered some of its intraday losses and traded around 1.2575-1.2580.

–Are you interested in learning more about spread betting brokers? Check our detailed guide-

As fresh dollar buying occurred on the first day of the new week, the pair struggled to capitalize on Friday’s sharp recovery from its lowest level since July 2020. Fed tightening is helping the dollar regain positive momentum, bringing it near a multi-year high set last week.

The market expects the US Federal Reserve to raise rates faster than expected, eventually raising interest rates to around 3.0% by the end of the year to combat persistently high inflation. In turn, higher US Treasury yields had a positive impact on the US dollar, affecting the GBP/USD pair downward.

The Sterling’s value was also undermined by indications that the UK economy is under pressure due to sharp rises in the cost of living. Based on weak retail sales figures released last month, consumer spending is already being affected by high inflation. Consequently, investors were forced to scale back their expectations of further Bank of England rate hikes.

What’s next to watch?

Even though the downside potential is muted, investors appear reluctant to bet aggressively ahead of key central bank events this week. Nevertheless, it is expected that the Fed will raise rates by 50 basis points at the end of its two-day meeting on Wednesday. The Bank of England will follow this with a policy update on Thursday.

The closely-watched US jobs report, or NFP, scheduled for the start of the new month will also help set a short-term course. In addition, traders will also be watching the US ISM Manufacturing PMI, which could affect the US dollar and strengthen the GBP/USD pair later in the North American session.

–Are you interested in learning more about Australian brokers? Check our detailed guide-

GBP/USD price technical analysis: Bulls to move above 20-SMA

The GBP/USD price dropped from today’s daily highs, but the pair remains supported by the 20-period SMA on the 4-hour chart. Apparently, the volume data seems to favor the Sterling bulls. However, it is vital for the pair to find acceptance above the 20-period SMA. The average daily range is 50% for the pair, which indicates a normal volatility day.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money