GBP/USD closed the week at 1.2954, almost unchanged from the start of the week. There are 10 events this week. Here is an outlook on the major market-movers and an updated technical analysis for GBP/USD.

In the UK, the current account deficit narrowed in Q2 and beat the forecast, while Final GDP for Q2 was revised to 0.7%, edging above the forecast of 0.6%. Over in the US,consumer confidence came out at the highest since 2007, but durable goods orders were mixed. Final GDP for Q2 was slightly better than expected in the US, but at 1.4%, growth remains weak.

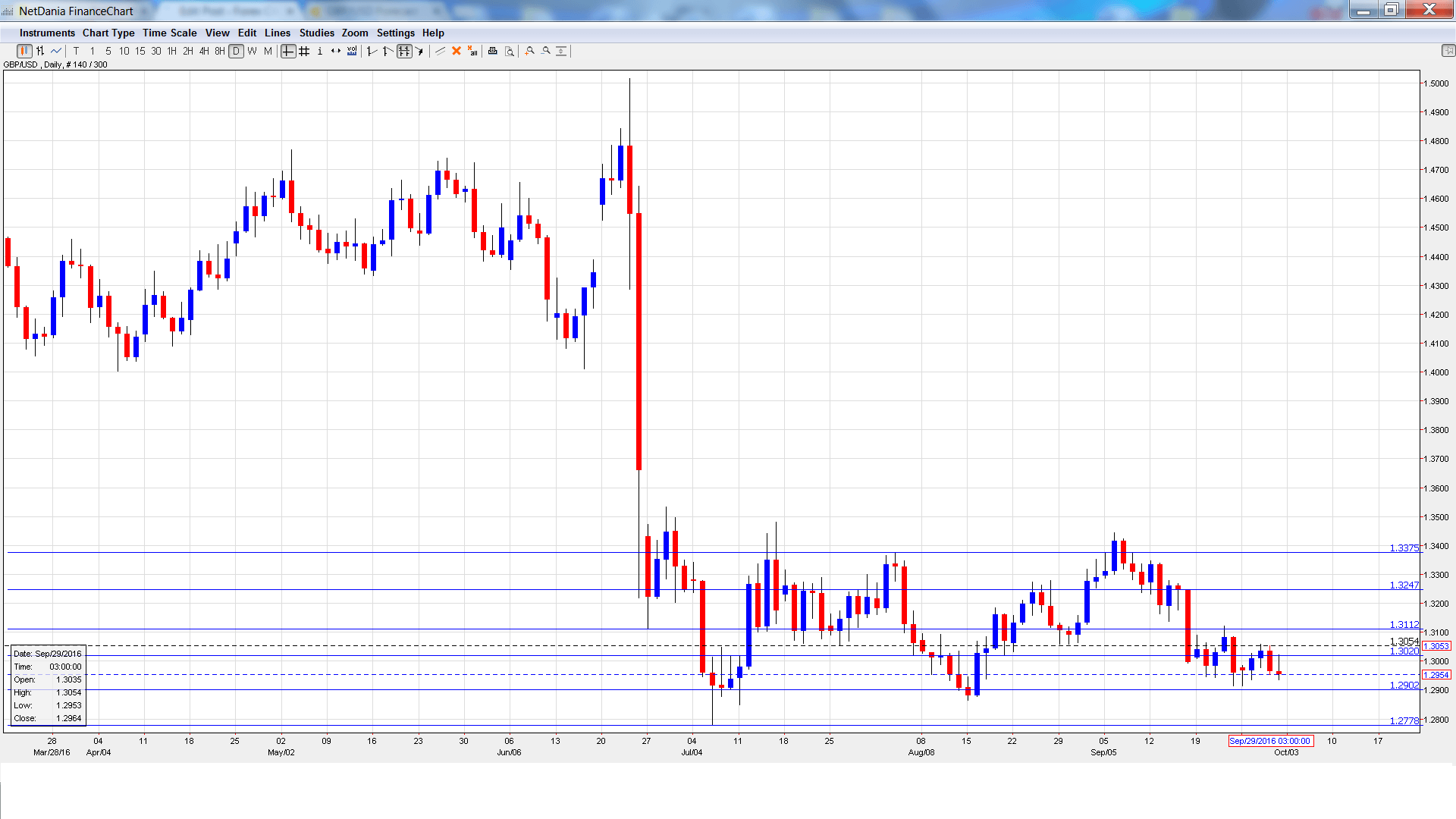

GBP/USD graph with support and resistance lines on it. Click to enlarge:

- Manufacturing PMI: Monday, 8:30. The index improved to 53.3 points in August, pointing to expansion. This beat the estimate and marked the indicator’s highest level since October 2015. The estimate for the September release stands at 52.1.

- Construction PMI: Tuesday, 8:30. The indicator has posted three straight readings below the 50-level, which indicates contraction. The indicator improved to 49.2 in August, and little change is expected in the September release.

- BRC Shop Price Index: Tuesday, 23:01. This consumer inflation indicator continues to post declines and weakened in August with a reading of -2.0%.

- Services PMI: Wednesday, 8:30. The index jumped to 52.9 in August, easily beating the estimate of 49.1. This marked a 4-month high. The estimate for the September reading stands at 52.1.

- Housing Equity Withdrawal: Thursday, 8:30. Withdrawals narrowed to GBP -4.9 billion in Q2, much better than the estimate of -10.1 billion. The estimate for Q3 is GBP -5.4 billion.

- 30-year Bond Auction: Thursday, Tentative. The yield on 30-year bonds continues to drop, and fell to 1.53% in the September auction.

- Halifax HPI: Friday, 7:30. This housing inflation indicator provides a snapshot of the level of activity in the housing sector. The index has posted two straight declines and the September estimate is 0.0%.

- Manufacturing Production: Friday, 8:30.This key indicator has struggled, posting three consecutive declines. Better news is expected in the August report, with a forecast of 0.4%.

- Goods Trade Balance: Friday, 8:30. Britain’s trade deficit narrowed to GBP 11.8 billion, very close to the forecast. The positive trend is expected to continue in August, with an estimate of GBP 11.1 billion.

- NIESR GDP Estimate: Friday, 14:00. This monthly indicator helps analysts predict GDP, which is released every quarter. The indicator has been steady, posting a gain of 0.3% in the past two months.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.2977 and touched a low of 1.2915, as support held at 1.2902 (discussed last week). The pair then rebounded and climbed to a high of 1.3058. GBP/USD was unable to consolidate at this level and closed the week at 1.2954.

Live chart of GBP/USD:

Technical lines from top to bottom

1.3372 was a cap in August.

1.3247 is next.

1.3112 marked a low point in June as the pound crashed after the Brexit vote.

1.3020 remains a weak resistance line.

1.2902 remains an immediate support line.

1.2778 was a cushion in mid-July.

1.2612 was a cushion back in 1985. It is the final support line for now.

I remain bearish on GBP/USD.

The BoE dropped broad hints in September that it plans to lower rates in November. In the US, it’s the opposite story, as the Fed appears inclined to raise rates in December if key numbers remain steady. So, the greenback should continue to benefit from monetary divergence. Although recent UK data has been decent, the markets remain braced for some weak numbers in the third quarter due to Brexit.

Our latest podcast is titled Bold BOJ vs. Fearful Fed

Follow us on Sticher or iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.