The British pound suffered from higher unemployment and the European debt crisis and lost a lot of ground. A revision of Q3 GDP is the highlight of the week. Here is an outlook for the upcoming events and an updated technical analysis for GBP/USD.

British inflation dropped to 5%, still far above the official target, but what’s really worrying the central bank is the high unemployment, which will eventually lead prices to fall. We’ll get to hear more from the BOE in the meeting minutes.

Updates:The pound began the week with a downfall, as talks of more QE rise again. It holds above the 1.5633 line at the time of writing. The pair eventually dropped under 1.5633 and continues lower. The OK PSNB didn’t help the pound – fears of global recession that come form the downgraded US GDP weigh on the pound. British MPC Minutes have shown that there is tendency for more QE alongside fears that inflation may not fall so fast. GBP/USD continues falling on chances of more QE, as well as fears about the European credit crunch and the global slowdown, see especially from China. On one hand, the British pound is suffering from the euro-zone debt crisis and the pound fell lower, reaching 1.55. On the other hand, the disastrous bond auction in Germany sends Japanese investors to the British gilts, which suddenly became safe havens, and this helps stabilize the pound. The euro crisis, with downgrades for Portugal and Hungary (even if outside the euro) continues pushing GBP/USD lower. The 1.5271 line is not too far.

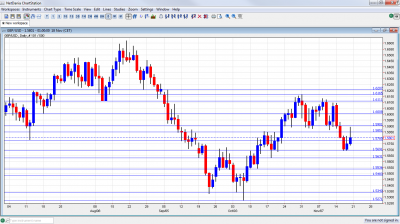

GBP/USD graph with support and resistance lines on it. Click to enlarge:

- Rightmove HPI: Monday, 00:00. This is an early report, for the current month. According to Rightmove, the past two months were positive, with an especially strong rise of 2.8% in house prices last month. A drop is likely now.

- Public Sector Net Borrowing: Tuesday, 9:30. The British government is fighting debt and managed to distance itself from the European economies. Nevertheless, it usually has a monthly deficit which topped 11 billion pounds last month. A smaller deficit is likely now – 4.3 billion.

- MPC Meeting Minutes: Wednesday, 9:30. After expanding the QE program in October, the members of the Monetary Policy Committee made no policy changes in the recent meeting. We will now see if this decision was unanimous, or if some members wanted even more QE. This publication has a strong impact on markets.

- BBA Mortgage Approvals: Wednesday, 9:30. The British Bankers’ Association represents around two thirds of mortgages approved in the UK. After a few months of steady rises, an unexpected drop was recorded in September, to 33.1K. Another drop is likely now. to 32.3K.

- Revised GDP: Thursday, 9:30. The first release of GDP for the third quarter was quite encouraging: +0.5% following weak growth of 0.1% in Q2. This will likely be confirmed now, in the first revision. A final revision will follow. A downwards revision will hurt the pound.

- Business Investment: Thursday, 9:30. More investment means more economic activity. This is the initial publication, and a significant revision is likely here. In Q2, a leap of 11.6% was recorded.

- CBI Industrial Order Expectations: Thursday, 11:00. The Confederation of British Industry has shown a significant deterioration in orders. The figure plunged from -9 to -18, expressing a significant significant negative downturn. Another small drop is expected now to -19.

* All times are GMT.

GBP/USD Technical Analysis

Pound/dollar fell sharply at the beginning of the week, and lost the 1.60 line (mentioned previously). It then continued lower, bottoming out at 1.5691 before recovering and finishing at 1.5801.

Technical levels from top to bottom

After the downfall, we begin from a lower level. The round number of 1.62 worked in both directions during many months of range trading and wasn’t approached now. 1.61665 folows closely after capping an attempt to rise..

1.6110 is now a minor line that served better as support than resistance and has weakened lately. The round number of 1.60 was fought over and finally lost. It switches to resistance. Also this line worked well in both directions during 2011.

The round number of 1.59 was the bottom border then the pair traded lower, and couldn’t be reconquered. 1.5850 proved to be a tough line of resistance before the recent break higher and now returns to its previous role..

It is followed by the swing low of 1.5780, a minor resistance in 2010, which is minor support now. 1.5690 joins the chart after being the bottom of the crash in November. It capped the pair earlier.

1.5633 worked as support during September was only very temporarily breached in October. It is followed by 1.5530 which was the bottom line of the recent range, and had a similar role back in 2010. It now turns into support.

Further below, 1.5480 was support and resistance in the past, and lately in September. 1.5340 also had a role early in the year, and the pair bounced off this line in September.

The last line is the trough of 1.5271, which was reached after the announcement of QE2 in Britain.

I remain bearish on GBP/USD.

Britain cannot fully separate itself from the continent. While the yields are doing better, the euro-zone is an important market. The recent UK job figures show that the situation remains dire in the UK.

If you are interested in GBP/JPY and technical setups for this pair with binaries, see this week’s GBP/JPY binary technical setup.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For USD/CAD (loonie), check out the Canadian dollar

- For the Swiss Franc, see the USD/CHF forecast.