- USD/CAD pair seems positive but neutral.

- Poor US ADP data is weighing on the Greenback.

- Fed’s Clarida left some hawkish comments that lent brief support.

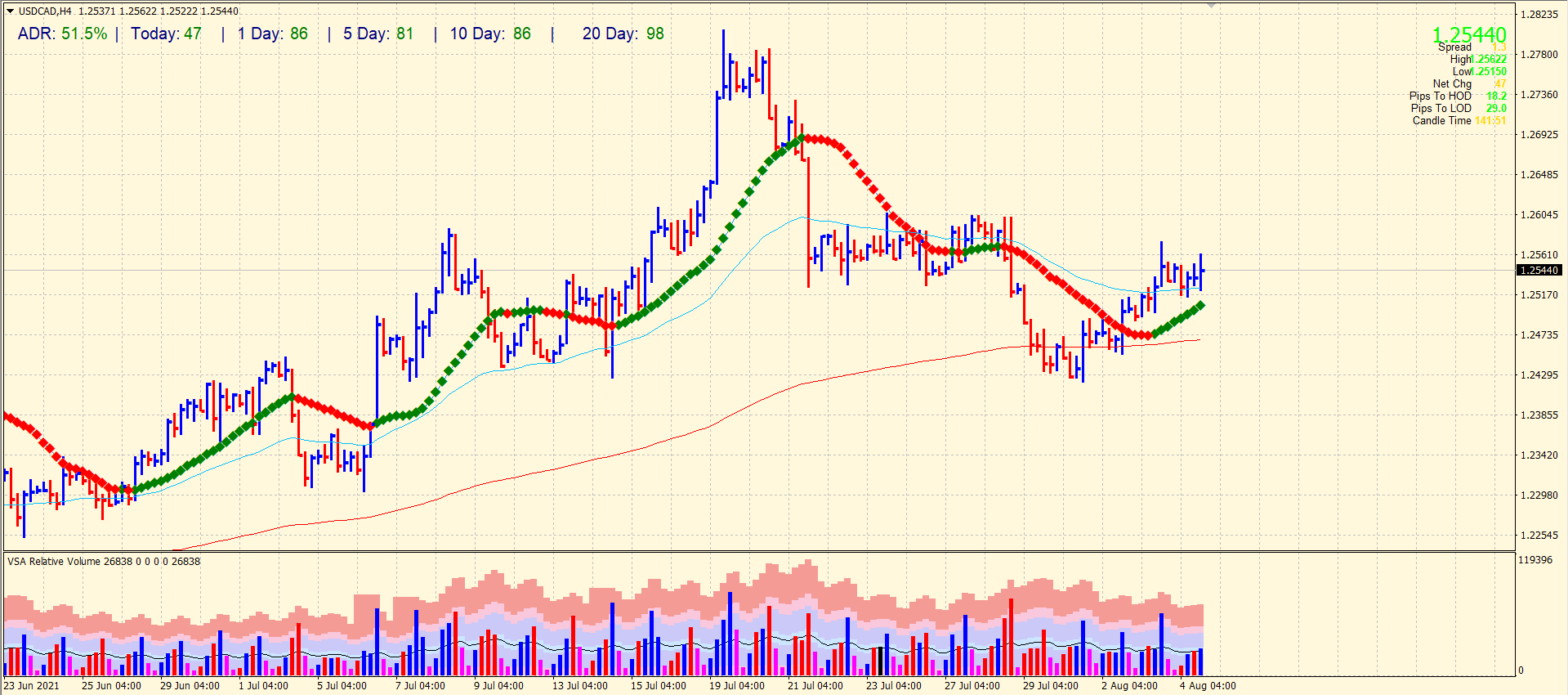

The USD/CAD analysis is neutral as the pair is on the defensive through NY trading hours, shedding small amounts in the 1.2530-40 area.

After hitting the previous session’s low of 1.2575, the pair dropped in early trading on Wednesday. However, the decline was totally driven by a mild decline in the US dollar.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

The USD ADP employment change figures came at 330k against the expected 695k while the previous month showed 680k. On the other hand, Canadian building permit numbers came at 6.9% against a forecast of 6%. So, the pair is under pressure amid divergence in the data of both economies.

Now, investors seem confident that the Fed will maintain its super-soft monetary policy for a period. These factors kept the dollar weak and put some pressure on the USD/CAD pair. Nevertheless, many factors prevented the downside from occurring.

The US dollar’s safe-haven status is bolstered by fears the rapidly spreading delta variant of the Coronavirus could stall the global economic recovery. In addition, a softening of oil prices also eroded the commodity pegged Canadian dollar, thus supporting USD/CAD.

A rising number of COVID-19 cases is weighing on crude oil prices, prompting fears of fuel demand being limited. However, an overnight bullish report from the American Petroleum Institute and geopolitical tensions in the Persian Gulf appear to have temporarily eased concerns over demand.

Fed’s Clarida spoke recently and her hawkish tone has poured some life into the weaker Dollar. She reiterates the rate hike expectations to be met by end of 2022.

–Are you interested to learn more about forex signals? Check our detailed guide-

USD/CAD technical analysis: Are bulls strong enough to march higher?

The USD/CAD pair is consolidating under mid-1.2500 just above the 50-period SMA. The price is also lying well above the 20-period and 200-period SMAs. However, yesterday’s failed attempt to gain 1.2600 is keeping the pair under pressure. Last day’s 4-hour up bar closed in the middle with ultra-high volume. It indicates that the buyers have exited and no fresh buying has started so far. Hence, there is no clear signal to buy or sell the pair at the moment. Hence, traders may need to wait and watch until a fresh trend wave triggers.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.