- The USD/CAD accepts bids to refresh its multi-day low for the third day in a row.

- Geopolitical concerns and cautious optimism about Omicron support the oil price.

- Curfews have been imposed in Quebec to stop the spread of the virus, and reports from the US indicate a high number of Covid cases.

The USD/CAD price forecast remains in the background early Friday morning, accepting bids around 1.2730 to re-hit multi-day lows in Europe.

–Are you interested to learn more about Nigerian forex brokers? Check our detailed guide-

Earlier Asian risk appetite may have been reinforced by a modest rise in oil prices, resulting in the recent decline in USD/CAD. However, the lack of key data/events and poor liquidity at the end of the year may limit the pair’s immediate movement.

In the previous round, WTI crude oil, Canada’s number one export, gained 0.05% on the day as it reached a five-week high. The market may have been anticipating fewer health emergencies due to the South African variant of Covid Omicron and concerns over geopolitical tensions in the Middle East.

It’s worth noting that global politicians, including those in Canada, are taking Omicron lightly since they’ve moved away from big companies ceasing operations during the celebrations. On the other hand, Quebec has a curfew from 10:30 pm until 5:00 am. Meanwhile, Reuters’ 7-day average for the number of new Coronavirus cases in the United States has hit a record high for the second day in a row.

The Iranian space launch is a blow to previous optimism about a denuclearization agreement with world leaders. China and Hong Kong, too, rejected US demands for the release of Hong Kong journalists. In addition, according to Reuters, escalating tensions over Ukraine could disrupt relations between the US and Russia, with US President Joe Biden warning on Thursday.

During these games, Wall Street benchmarks posted small losses, while the S&P 500 futures suffered intraday losses and most recently lost 0.20% in a single day.

Given firmer oil and improved market sentiment, the USD/CAD bears are likely to maintain control. The liquidity crisis at the end of the year may limit the pair’s movement during the day, though.

–Are you interested to learn more about Islamic forex brokers? Check our detailed guide-

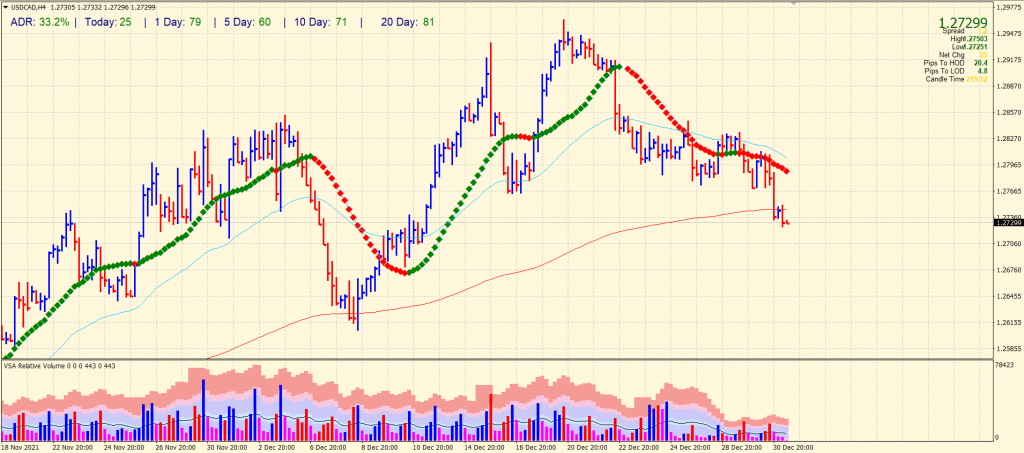

USD/CAD price technical forecast: Bearish dominance

The USD/CAD price has dropped below the 200-period SMA on the 4-hour chart. The technical outlook is negative as the widespread down bar with very high volume indicates bearish dominance. The average daily range is 33% which is usual for the pair during the pre-European session. However, we do not expect much volatility on the day amid New Year’s Eve.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.