- The USD/CAD is steady after recovering from a five-week low in two days.

- As the tension between Russia and Ukraine grows, discussions of a deal between Venezuela and the United States are underway, and two fields in Libya are closed. As a result, WTI oil has updated a 14-year high.

- The strong US jobs report, the Fed’s dovish stance, and the demand for safe-haven assets are positive factors for the DXY.

- Short-term directions will be determined by employment statistics in Canada and oil news.

The USD/CAD outlook is bearish as the crude oil prices rise amid fear of supply chain disruption stemming from the Russia-Ukraine crisis.

–Are you interested in learning more about copy trading platforms? Check our detailed guide-

Early Monday morning in Europe, sellers target the 1.2700 line and renew the intraday low. However, the loonie pair is challenging to portray risk-off market sentiment as Canadian oil prices rise and the US dollar index (DXY) strengthens.

Rising WTI prices

The WTI crude price rose to its highest level since late 2004 and earlier surpassed $125.00 in Asia, up 7.0% near $121.40 at press time. However, OPEC+ has been stifling further action to address Russia-related concerns due to black gold concerns. In addition, the news agency reported that there was a drop of 330,000 barrels of oil production due to an armed attack at two oil fields in Libya, according to VOA News.

The US, Denmark, Canada, and the UK consider banning Russian oil imports. However, they may prefer Middle East routes for energy supplies, underlining recent discussions with Venezuela and Iran that have tested oil buyers.

Chinese trade data for February has also lifted oil prices and given hope to the USD/CAD pair that has been in decline since January.

Hawkish Fed and upbeat jobs data

The US Dollar Index (DXY) also reached a 22-month high before falling to 98.93 at the time of printing, up 0.45% on the day.

In addition to the US jobs report and hawkish remarks from Chicago Fed President and FOMC member Charles Evans, the recent deterioration in Ukraine-Russia relations also contribute to the dollar’s bullishness.

What’s next for the USD/CAD outlook?

Futures on the S&P 500 fell 1.30%, and the US 10-year Treasury yield fell 2.5 basis points (bps) to 1.69% amid these games, suggesting a strong risk appetite.

USD/CAD traders will be watching Canadian employment data and the US consumer price index (CPI) for February, but the focus will be on risk catalysts to set direction.

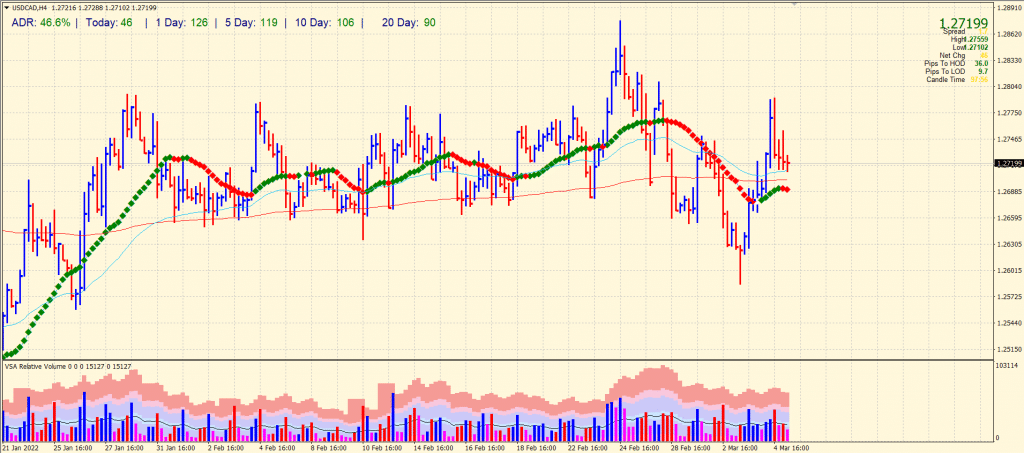

USD/CAD price technical outlook: Bears emerging

The USD/CAD price is sliding towards the congestion of key SMAs on the 4-hour chart. The pair has formed a widespread down bar followed by three more down bars including a hidden upthrust. This indicates a sign of weaknesses in the pair. We may see the price drifting below the 1.2700 mark. The next support could be 1.2650.

–Are you interested in learning more about scalping forex brokers? Check our detailed guide-

On the upside, the pair may find resistance around Friday’s top at 1.2791 ahead of 1.2850 and then 1.2900. The probability of an upside remains low.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money