- Oil prices are rising on the back of the weaker dollar, boosting the Canadian dollar.

- The US dollar is trading at its lowest level since October 6.

- Business inflation forecasts in Canada remain high.

Today’s USD/CAD price analysis is bearish as the Canadian dollar gains ground on rising oil prices. Tuesday saw an increase in oil prices, supported by a weaker dollar and supply issues.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

Still, gains were restrained by the threat of declining fuel demand from China, provided it maintains its strict zero-COVID policy. The US dollar index, which compares the US currency to six other major currencies, fell to its lowest since October 6.

Elsewhere, a Bank of Canada survey released Monday revealed business confidence has weakened in Canada as many companies anticipate weaker sales growth amid rising interest rates and decreasing demand. Most businesses believe a recession will likely occur within the next 12 months.

The third quarter Business Outlook Survey revealed that business inflation forecasts remain high despite early indications of moderating pressures on prices and wages. While longer-term expectations have lowered, consumers still anticipate larger price increases in the immediate future, according to a separate survey.

“While many firms anticipate a recession, those not linked to housing activity and other household consumption do not expect it to have a large impact on demand for their products and services,” the report said.

Since March, the Bank of Canada has increased its policy rate by 300 basis points; money markets anticipate an additional 50 bp increase to 3.75% at its upcoming decision on October 26.

USD/CAD key events today

Investors expect the housing starts report from Canada, which measures the yearly number of new residential buildings that started construction during the reported month.

USD/CAD technical price analysis: Downside reversal aiming at 1.3605

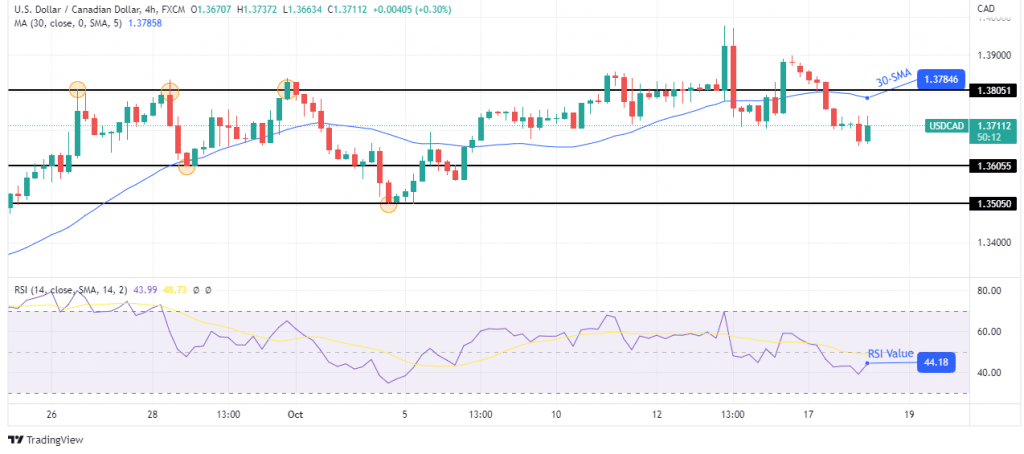

Looking at the 4-hour chart, we see the price trading below the 30-SMA and the RSI below 50, showing bears are in charge. Bears have confirmed the new downtrend by making a lower low. The next part of the confirmation would be a lower high.

-Are you looking for the best MT5 Brokers? Check our detailed guide-

Currently, the price looks set for a pullback. If the pullback retests the 30-SMA as resistance and pushes it off to the downside, the downtrend will be confirmed. The next targets for bears are at the 1.3605 support and lower at the 1.3505 support.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.