- The USD/CAD pair developed a new leg higher after signaling exhausted sellers.

- Worse than expected, Canadian data could boost the pair.

- A new higher high could activate an upside continuation.

The USD/CAD price ended its downside movement and developed a new leg higher. The pair is trading at the 1.2589 level at the time of writing, and it could reach new highs if the Dollar Index resumes its growth.

–Are you interested in learning more about AI trading brokers? Check our detailed guide-

As you already know, DXY is strongly bullish. Further growth should help the USD to dominate the currency market. Still, the currency pair reached a strong upside obstacle in the short term. So, we’ll have to wait for strong confirmation. After its amazing rally, we cannot exclude a minor retreat. The price could return to test and retest the immediate support levels before resuming its growth.

The USD/CAD pair resumed its growth as the greenback received a helping hand from the US Unemployment Claims, which came in at 166K in the last week below 201K estimates, while the Consumer Credit was reported at 41.8B compared to 18.0B expected.

Today, Canadian data could be decisive. The Employment Change could be reported at 77.5K in March versus 336.6K, while the Unemployment Rate could drop from 5.5% to 5.4%, which could be good for the Loonie. On the other hand, the Final Wholesale Inventories could report a 2.1% growth.

USD/CAD price technical analysis: Upside bias

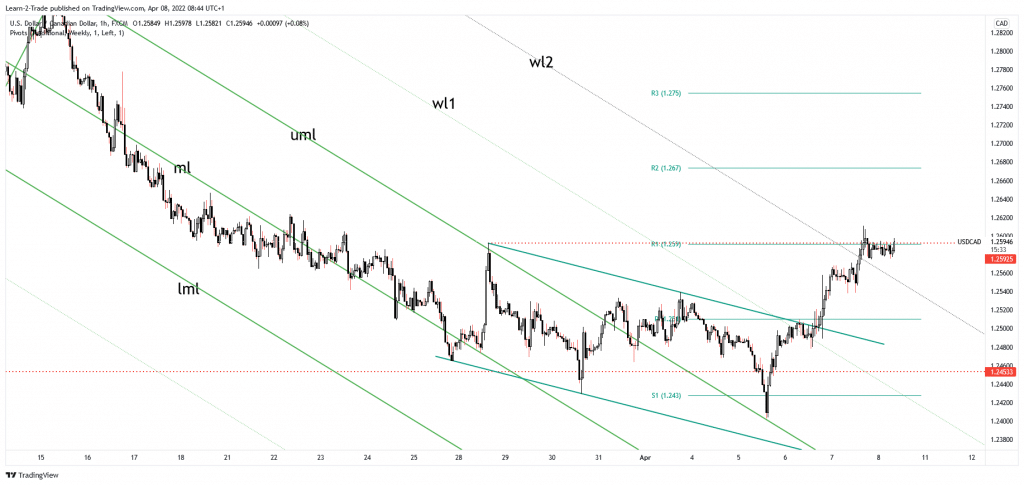

The USD/CAD pair developed a strong leg higher after retesting the descending pitchfork’s upper median line (UML). It has escaped from the down channel pattern signaling further growth. It has passed above the second warning line (wl2) of the descending pitchfork, but it has reached the 1.2592 static resistance.

–Are you interested in learning more about spread betting brokers? Check our detailed guide-

It remains to see how the pair will react around this level. Better than expected, Canadian figures could send the rate down in the short term. On the contrary, poor data could lift the pair. A new higher high, jumping and closing above 1.2611, could activate an upside continuation.

Coming back to retest the second warning line (wl2) could bring new long opportunities. Also, don’t forget that the rebound could be only a temporary one, but it’s premature to talk about a new strong leg down.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money