- The USD/CAD pair could try to rebound after its massive drop.

- The price could be lifted by a hawkish FED later today.

- The FOMC Press Conference could bring sharp movements in both directions.

The USD/CAD price plunged in the short term after reaching 1.2871. The pair is trading at 1.2730 at the time of writing. The price has tried to rebound but the bearish pressure remains high.

–Are you interested in learning more about making money with forex? Check our detailed guide-

After its massive drop, a temporary rebound was somehow expected. Unfortunately, for the USD, the United States retail sales data came in worse than expected. That’s why the currency pair remains bearish. The Retail Sales indicator rose by 0.3% in February, less versus the 0.4% growth expected and compared to 3.8% growth in January. In addition, the Core Retail Sales surged by only 0.2% versus 0.9% expected, Import Prices rose by 1.4% less versus 1.7% expected, while the Business Inventories registered a 1.1% growth versus 1.2% expected.

Earlier today, the Canadian CPI reported at 1.0% growth versus 0.9% expected growth compared to 0.9% in the previous reporting period. Furthermore, the Core CPI rose by 0.8% in February, the same as in January, while the Wholesale Sales surged by 4.2% more versus 4.0% forecasts. Still, the most important event of the week is represented by the FOMC.

As you already know, the FED is expected to hike its Federal Funds Rate from 0.25% to 0.50%. So, most likely, the FOMC Press Conference and the FOMC Statement could really shake the markets. That’s why you have to be careful.

USD/CAD price technical analysis: Bears to dominate

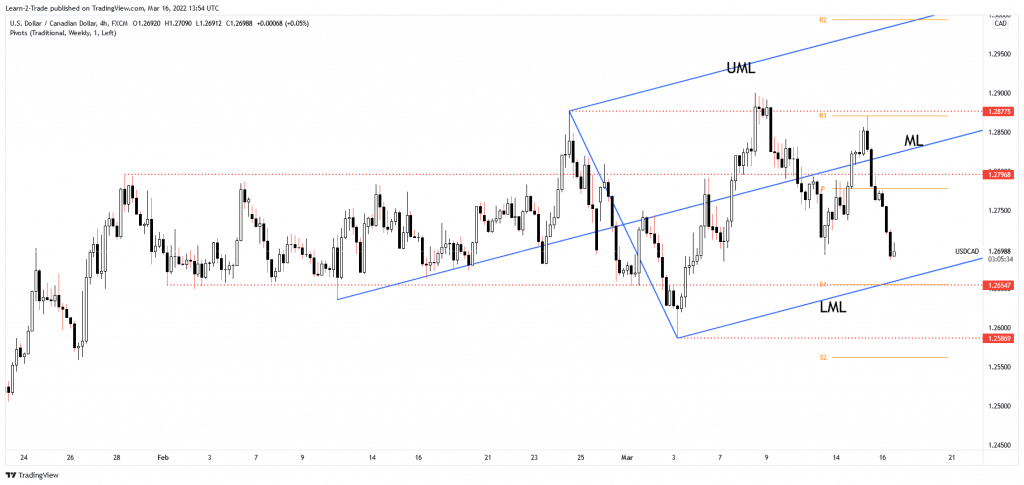

As you can see on the 4-hour chart, the USD/CAD pair failed to reach and retest the 1.2877 static resistance or the 1.2901 higher-high signaling bearish pressure. Also, its failure to stay above the ascending pitchfork’s median line (ML) signaled that the upward movement could be over. Instead, it has reached the 1.2693 former low, which is static support.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

In the short term, it remains sideways, so the rice can extend its range. More hawkish than expected, FED could boost the USD. That’s why the currency pair could recover. Technically, the ascending pitchfork’s lower median line (LML) represents dynamic support. A bullish reversal pattern around this level could announce a new leg higher.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money