- The USD/CAD is slowly recovering from the 3-week low despite the recent reversal from the intraday bottom.

- While market participants are paring the previous day’s losses, WTI oil remains on hold amid geopolitical concerns and OPEC+ expectations.

- US President Biden confirmed that Russian flights would be banned from US airspace.

- The BOC will raise interest rates for the first time since 2017, Powell said, and ADP will transform US employment as well.

The USD/CAD price shows slight losses early Wednesday morning, despite recovering from intraday lows. The losses are attributed to strong WTI.

–Are you interested in learning more about managed forex accounts? Check our detailed guide-

As traders await the Bank of Canada (BOC) interest rate decision, the pair have maintained a pause amid a wave of risk aversion and high prices for WTI Crude Oil, Canada’s top export.

Early Wednesday, global market sentiment improved following two days of risk aversion due to the standoff between Ukraine and Russia. From US President Joe Biden’s State of the Union (SOTU) address, it can be seen that risk appetite has improved as the United States has shown its willingness to be “self-sufficient” and fight inflation, as well as forbidding Russian flights out of the US airspace.

At the start of the Asian session, the US 10-year Treasury yield increased by around 1.75%, at least four basis points (bp) on the back of the sentiment and precious metals consolidation. However, S&P 500 futures tempered initial gains, rising 0.10% to 4310 points on the day.

WTI Crude Oil exceeded the June 2014 peak the day before, rising to $109.30 in a matter of minutes. The Russian invasion of Ukraine led to a rise in black gold prices related to supply concerns. In addition, oil buyers have received favorable comments from the Organization of the Petroleum Exporting Countries (OPEC) and its Russian-led allies, known as OPEC+. Reuters reports that the oil cartel will stick to its existing policy of increasing production by 400,000 barrels per day each month in April at its meeting today. According to the news, “Russia’s invasion of Ukraine has not yet adversely affected the OPEC+ deal.”

Bank of Canada’s (BOC) interest rate changes and future outlook will become more important as markets have already priced in the much-anticipated 0.25% rate hike in the coming months. Any disappointment could therefore push USD/CAD rates higher.

To provide direction, it is also essential to follow the headlines of Chairman Powell’s Russia-Ukraine and biennial reports and ADP’s February US employment report.

–Are you interested in learning more about crypto brokers? Check our detailed guide-

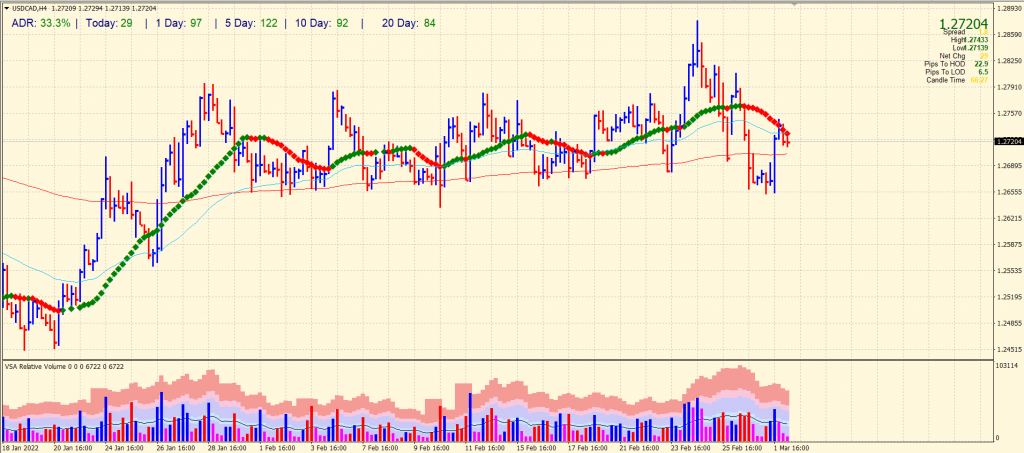

USD/CAD price technical analysis: Bulls on the way up

The USD/CAD price remains capped between 200-period and 20-period SMAs on the 4-hour chart. The pair posted a strong recovery from the mid-1.2600 area, forming a widespread up bar. However, the last three bars are paring gains, but the volume is declining. We can expect a sharp recovery towards the 1.2800 area. The average daily range is 33%, indicating a normal trading day.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money