- Canada’s inflation eased slightly in September but remained above BoC’s 2% target.

- Markets are expecting a 75bps rate hike from the BoC.

- BoC might continue raising rates if the dollar’s strength continues.

The USD/CAD weekly forecast is bearish as markets expect the BoC to raise rates by a massive 75 basis points.

Ups and downs of USD/CAD

While still significantly higher than the Bank of Canada’s target of 2%, Canadian inflation inched down to 6.9% in September from its peak of 8.1% in June. However, core price pressures did not appear to be easing.

–Are you interested to learn more about ECN brokers? Check our detailed guide-

According to governor Tiff Macklem, the economy is still overheated, and higher rates are needed to cool it down. This can be done, he added, without causing a recession. The pair ended the week lower as the Canadian dollar gained strength.

However, Macklem cautioned that rates could increase if the US dollar remains strong. The likelihood of a soft landing developing into a recession increases as interest rates rise.

The dollar was propelled by hawkish comments from Fed policymakers calling for more rate increases. The US labor market continues to be resilient in the face of rising interest rates allowing the Fed to maintain its aggressive stance.

Next week’s key events for USD/CAD

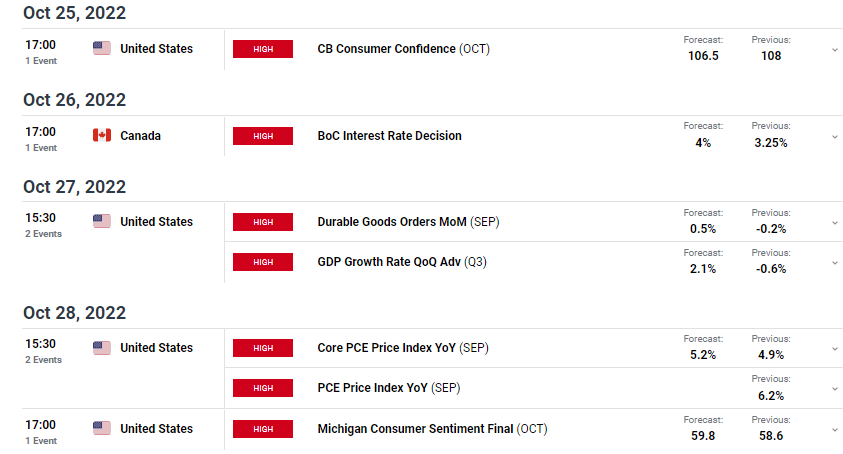

The central bank of Canada is set to proceed with another massive interest rate hike next week despite growing concerns about a recession. Data revealed that underlying inflation remained stubbornly persistent despite rigorous tightening.

At the Bank of Canada’s meeting on October 26, markets anticipate another 75-basis point hike, raising the policy rate to a 14-year high of 4.0%.

–Are you interested to learn more about making money in forex? Check our detailed guide-

USD/CAD weekly technical forecast: Bearish RSI divergence playing out

Looking at the daily chart, we see the price slightly below the 22-SMA and RSI slightly above 50. Although bulls still have more momentum, bears attempt to reverse the trend. The RSI has also made a bearish divergence with the price, showing the bullish trend has weakened.

Bulls could not break above the 1.3900 key resistance level, at which point bears took over. They have since pushed the price below the 22-SMA. The bearish divergence will play out nicely if bears can retest and break below the 1.3505 support level. This would mean making a lower low, further confirming a trend reversal. The price would then likely fall to the 1.3203 support level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.