- The SNB will continue raising interest rates after the 75bps rate hike.

- The SNB might intervene in the currency market if the franc becomes too strong.

- Swiss inflation has resurfaced, reaching 3.3% in September.

Today’s USD/CHF outlook is bearish. Andrea Maechler, a member of the SNB Governing Board, stated on Wednesday that the Swiss National Bank is willing to increase interest rates even higher to combat inflation after its most recent 75-basis-point increase. These hawkish comments strengthened the Swiss franc.

–Are you interested to learn more about AI trading brokers? Check our detailed guide-

The central bank is shifting its emphasis from trying to stop the rise of the safe-haven franc to controlling inflation. Inflation has resurfaced after being absent for the past 30 years, with Swiss inflation reaching 3.3% in September. The SNB will keep an eye on its inflation forecasts and try to bring inflation back to its target range of 0-2%.

The SNB is prepared to intervene in the currency markets as the franc strengthens. However, Maechler claimed that the strong Swiss franc helped mitigate the effects of increased imported prices.

“Interest rates are in the positive, that is a good thing. That means that monetary policy will be more steered through interest rates; we are returning to conventional monetary policy.”

“Still, the exchange rate will play an important role in our monetary conditions. We have said we are ready to intervene further when the franc is too strong and sell Swiss francs,” Maechler said.

USD/CHF key events today

Investors are awaiting the Initial Jobless Claims report from the US, which tracks the number of people who applied for unemployment benefits for the first time in the previous week.

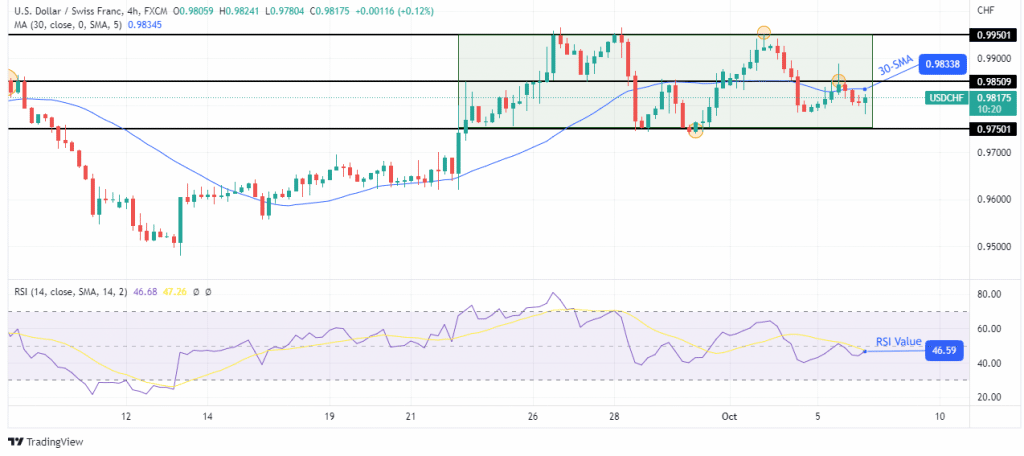

USD/CHF technical outlook: Bears prepare to retest range support at 0.9750

The 4-hour chart shows the price trading below the 30-SMA and RSI below 50, favoring bearish momentum. The price is, however, trading in a range with resistance at 0.9950 and support at 0.9750. The range midpoint at 0.9850 also offers solid support and resistance.

–Are you interested to learn more about Canada forex brokers? Check our detailed guide-

The price has just broken below and retested the 0.9850 key level and is looking to fall toward the range support at 0.9750. If this support holds strong, the consolidation will continue, with bulls coming in at the level. However, if bears gather enough momentum, the price might break below the support and start making lower lows.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.