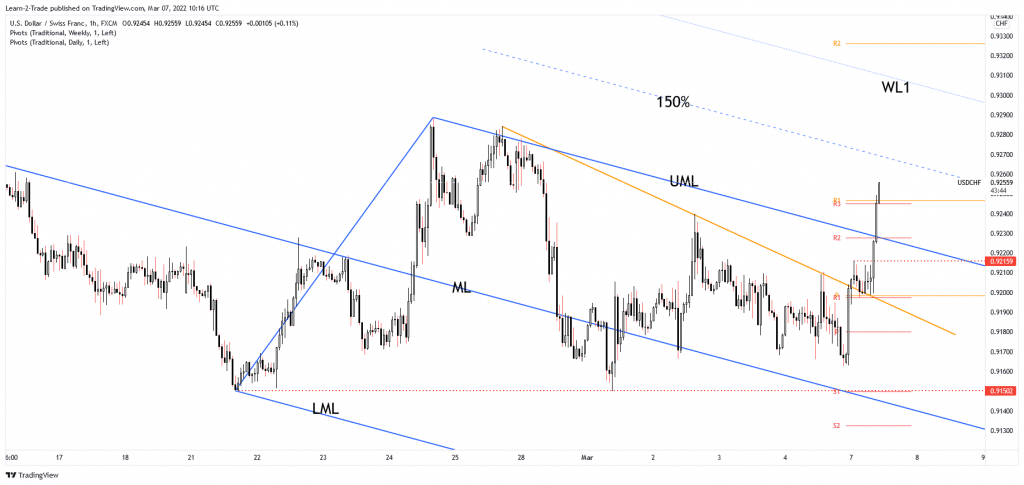

- The USD/CHF pair could resume its growth if it stabilizes above the broken obstacles.

- The breakout above the downtrend line signaled potential leg higher.

- A strong consolidation could announce an imminent breakout through the 150% Fibonacci line.

The USD/CHF price rallied after breaking the 0.92 psychological level. It has climbed as high as 0.9257 today during the European session. The current pair registered a 1.04% growth from 0.9162 today’s low to the daily high. Still, we cannot exclude a temporary decline after registering such a strong rally. However, despite temporary declines, the bias is bullish. The rate could only return to retest the immediate support levels before jumping higher.

–Are you interested in learning more about copy trading platforms? Check our detailed guide-

Fundamentally, the Unemployment Rate dropped unexpectedly from 2.3% to 2.2%, even if the traders expected the indicator to remain steady at 2.3%. In addition, the Foreign Currency Reserves indicator was reported at 938B. Later, the US will release Consumer Credit, which is expected at 24.7B.

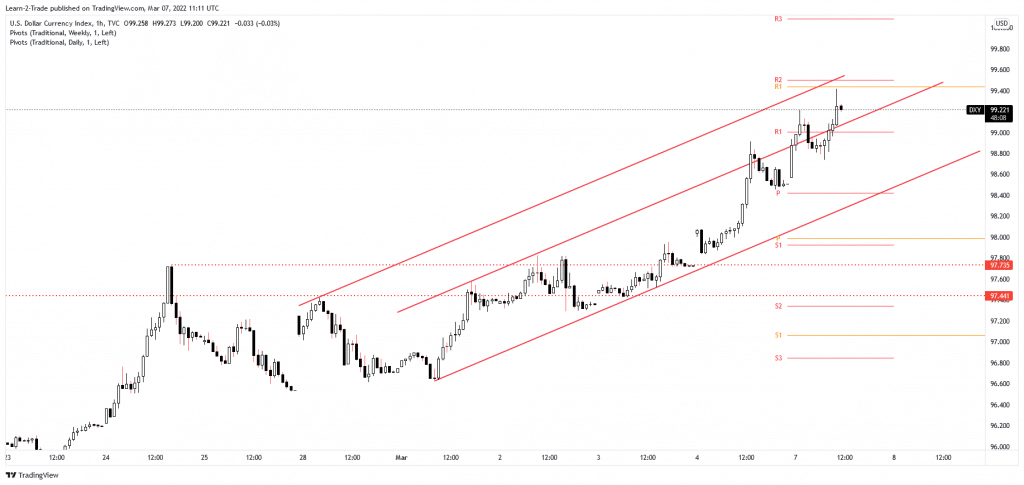

Dollar Index price technical analysis: Upside continuation

DXY is strongly bullish in the short term. That’s why the USD appreciated versus the Swiss Franc. As you can see on the 4-hour chart, the Dollar Index registered only temporary declines. Now, it has managed to jump far above the channel’s upside line. As long as it stays above, the DXY could extend its upwards movement.

The index rallied after the US Non-Farm Payrolls and the Unemployment Rate came in better than expected on Friday.

USD/CHF price technical analysis: Swing higher

The USD/CHF pair has managed to take out the dynamic resistance represented by the downtrend line. Furthermore, it has retested the broken line and the weekly pivot point of 0.9198, signaling strong buyers and a potential bullish momentum. Now, it’s located above the weekly R1 (0.9247) after ignoring the 0.9239 static resistance.

–Are you interested in learning more about scalping forex brokers? Check our detailed guide-

Technically, the aggressive breakout through the confluence area formed at the intersection between the descending pitchfork’s upper median line (UML) with the R2 (0.9227) signaled more gains ahead. Stabilizing above 0.9239 could announce potential further growth and help the buyers catch new long opportunities. A strong consolidation in the short term could announce an imminent breakout above the 150% Fibonacci line of the descending pitchfork.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money