- The move up for USD/JPY has stalled at 130.0, and the price is pushing lower.

- Thursday’s cheaper oil pushed the US dollar lower, and inflation fears cooled.

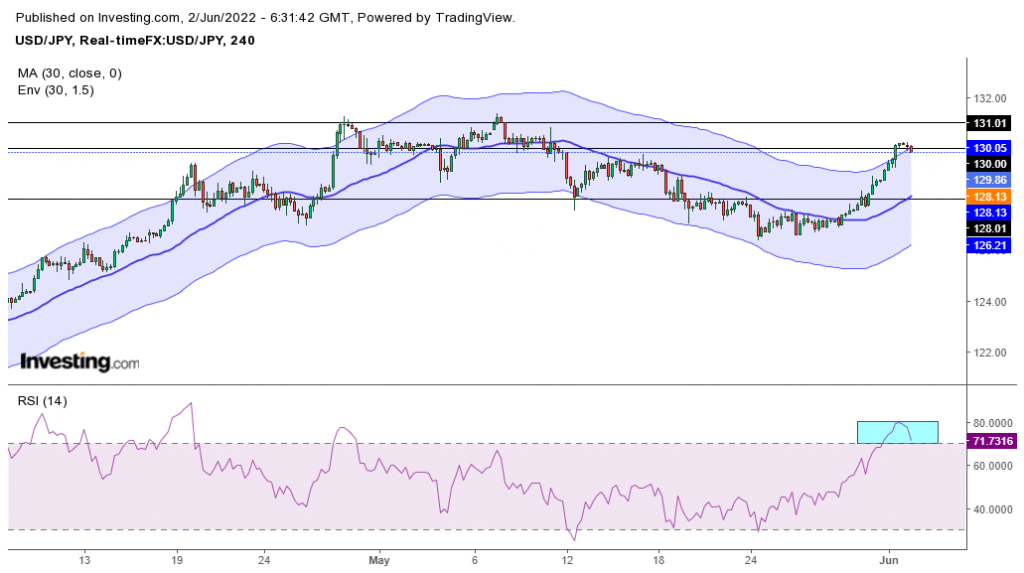

- A new bullish market has emerged in the 4-hour chart for USD/JPY.

The USD/JPY forecast seems positive amid a firm US dollar. However, the pause in the oil price rally has eased inflation concerns, limiting the pair’s upside.

-Are you interested in learning about forex indicators? Click here for details-

On Wednesday, a survey showed the US manufacturing activity was more robust than investors expected for May pushing the dollar and subsequently USD/JPY higher. This move cooled off Thursday morning as traders took profits at the 130.00 level.

The move down today can also be attributed to the hope investors got when there was news of a possible increase in oil production by Saudi Arabia in case Russia’s output dropped. This news cooled some of the inflation fears brought on by high energy prices. Increased production would reduce global supply pressures and lower oil prices.

A significant part of the inflation experienced by many economies worldwide is a result of high energy prices pushing the cost of living higher. Lower oil prices would therefore be an essential weapon against inflation. For this reason, Thursday morning saw USD/JPY give up some of its earlier gains.

USD/JPY key events today

News releases that could move USD/JPY today include those from the US and Japan. The ADP Nonfarm Employment Change, which investors expect to increase, is a good indicator for the Nonfarm Payrolls coming out tomorrow in the US. There is also the Initial Jobless Claims data which could push the pair higher if it goes down.

Not much is expected by investors from Japan apart from the services PMI for May.

USD/JPY technical forecast: Bulls eying at 131.00

The 4-hour chart shows the return of bullish momentum and a bullish market for USD/JPY. Prices broke above the 30-SMA, and RSI is currently trading in the overbought region. The RSI reading confirms the new move and changes the bias here to bullish.

-Are you interested in learning about the forex signals telegram group? Click here for details-

The price is currently experiencing a bit of resistance at the 130.00 critical level. At this level, the price could do one of two things. The first is that the price might bounce off the 130 level and pull back to the 30-SMA, and the second is that it might push higher to 131 before pulling back.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money