- On Monday, USD/JPY gained positive momentum due to a combination of factors.

- Rising US bond yields were helped by positive risk sentiment that undermined the safe-haven JPY Yen.

- Gains were capped by the start of some profit-taking in US dollars, which discouraged bulls from placing new bets.

The USD/JPY price traded just below 115.50, up almost 0.20% on the day, after retracing from the Asian session highs of 115.70.

–Are you interested to learn more about Islamic forex brokers? Check our detailed guide-

Despite the USD/JPY’s pullback from Friday’s high of 115.70, the pair attracted fresh buying on Monday, supported by various factors. First, a rebound in global risk sentiment, reflected in generally positive equity market sentiment, undermined the safety of the Japanese yen. In addition to rising Treasury yields and a hawkish FOMC meeting last week, bulls have also received signals from rising US Treasury yields.

Last Wednesday, the Fed hinted that it could raise interest rates faster than expected to curb rising inflation. Almost immediately, the market began to consider the possibility of five quarter-point rate hikes by 2022, with a possible first hike of 50 basis points in March. As a result, the US-Japan yield spread widened to its highest level since early February 2020; as a result, further weakening the yen.

However, the rise of the benchmark 10-year JGB to its highest level since January 2016 helped limit larger losses for the local currency. Traders have also held back further USD/JPY gains due to modest profit-taking in the US Dollar, at least for now. So, before positioning for the recent strong rally, it would be prudent to wait for strong follow-up buying.

The market now anticipates the release of the US economy report and the Chicago Business Index later during the North American session. This will boost the USD/JPY exchange rate in conjunction with US bond yields. Furthermore, traders will continue to look for broader market risk bias to take advantage of near-term opportunities around major currencies.

USD/JPY price technical analysis: Bulls retreating below 115.50

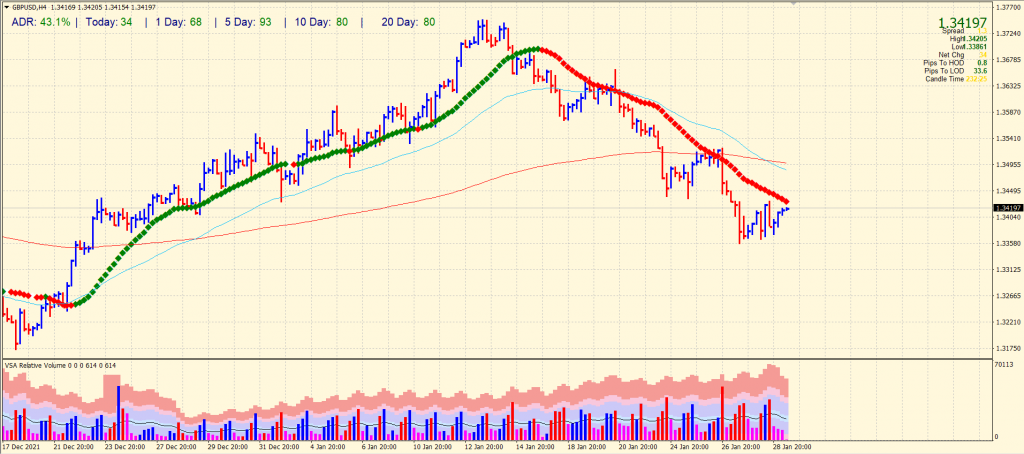

The USD/JPY price pauses the upside and forms an upthrust bar, closing below the 115.50 mark. The 20-period SMA on the 4-hour chart around 115.00 may attract the price towards itself. However, the bullish crossover of 50-period and 200-period SMAs continue to support the pair.

–Are you interested to learn more about Thailand forex brokers? Check our detailed guide-

The volume data is unclear at the moment, while the average daily range hits 56% as of now, indicating a highly volatile day ahead.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.