- Despite its 20-year high set the previous day, USD/JPY continues to fall.

- The yields on US Treasury bonds continue to fall in response to mixed Fed statements and lower inflation expectations.

- Headlines from China and Japan also support JPY’s corrective pullback.

- Investors may be entertained by risk catalysts ahead of Wednesday’s US inflation data.

The USD/JPY price is largely stable at around 130.30 throughout the day, holding a pullback from Monday’s multi-year high. Traders are taking a break from sharp volatility from the previous day as the yen also remains above intraday lows in Europe early Tuesday.

–Are you interested in learning more about STP brokers? Check our detailed guide-

In addition, USD/JPY remains mute despite falling US Treasury yields and moderate market optimism and comments from Bank of Japan (BOJ) CEO Shinichi Uchida.

The policymaker said the BOJ must continue to support the economy with the current monetary easing. Similar remarks were made by Japanese Finance Minister Shunichi Suzuki, who praised the divergence between Japanese and US monetary policies.

Ten-year US Treasury yields are extending the pullback from a 20-year high into earlier this week, falling at least five basis points (bps) near 3.0% amid fears of another interest rate hike by the Federal Reserve after Fed’s Raphael Bostic announced a series of 50 basis point rate hikes.

Thomas Barkin, the Richmond Fed chairman, left the possibility of a 75-basis point rate hike on the table. According to data from the St. Louis Federal Reserve (FRED), based on a 10-year breakeven inflation rate, the US inflation expectations fell the most in 10 months Monday, retesting levels seen in early March, according to data from the St. Louis Federal Reserve (FRED).

On the other hand, Liu He reaffirmed China’s proactive anti-coronavirus policies and provided much-needed relief to US stock futures near a yearly low.

What’s next to watch?

It should be noted that inflation concerns and China’s Coronavirus concerns continue to influence the USD/JPY pair. On the other hand, Russia’s refusal to retreat from its invasion of Ukraine is likely to strengthen the US dollar’s position as a safe haven. In the first place, Wednesday’s US CPI excluding food & energy for April, which is expected to be 6.0% y/y versus 6.5% previously, is critical, as the Fed could hike rates by 75 basis points.

–Are you interested in learning more about making money with forex? Check our detailed guide-

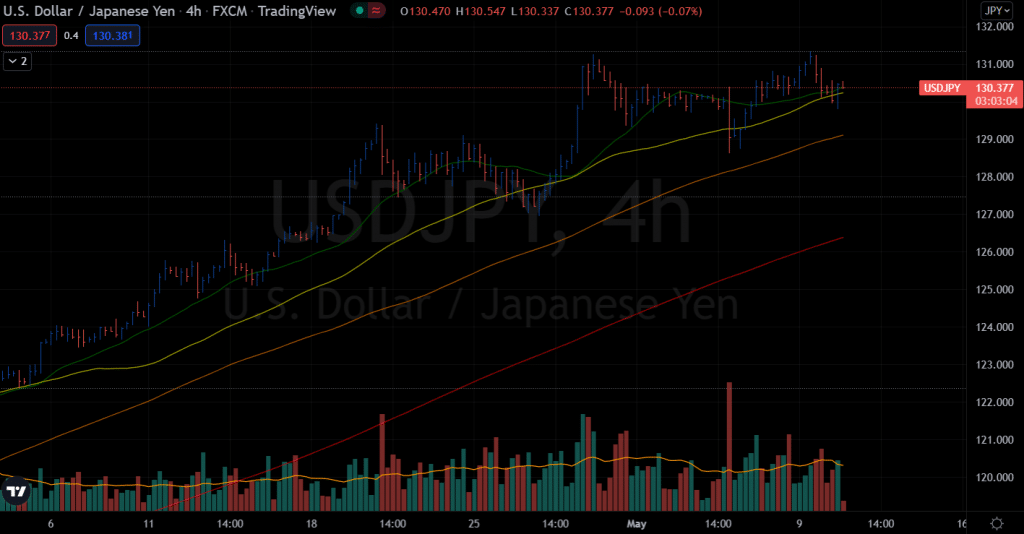

USD/JPY price technical analysis: Bears eying 100-SMA

The USD/JPY price remains wobbling around the 20-period SMA on the 4-hour chart. Although the price fell below the key SMA but managed to recover slightly. However, if the bearish pressure persists, the pair may fall towards the 100-period SMA near 129.00.

Contrarily, the 20-year highs above 131.00 will remain the obstacle for the bulls. Any further breakout may find traction to reach 135.00.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money