- The USD/JPY pair regained positive momentum on Thursday, reversing much of the overnight fall.

- The positive tone of risk and the differences in the policies of the Fed and the Bank of Japan put pressure on the yen and provided some support.

- The prospect of further tightening by the Fed and higher yields on US bonds spurred demand for the US dollar.

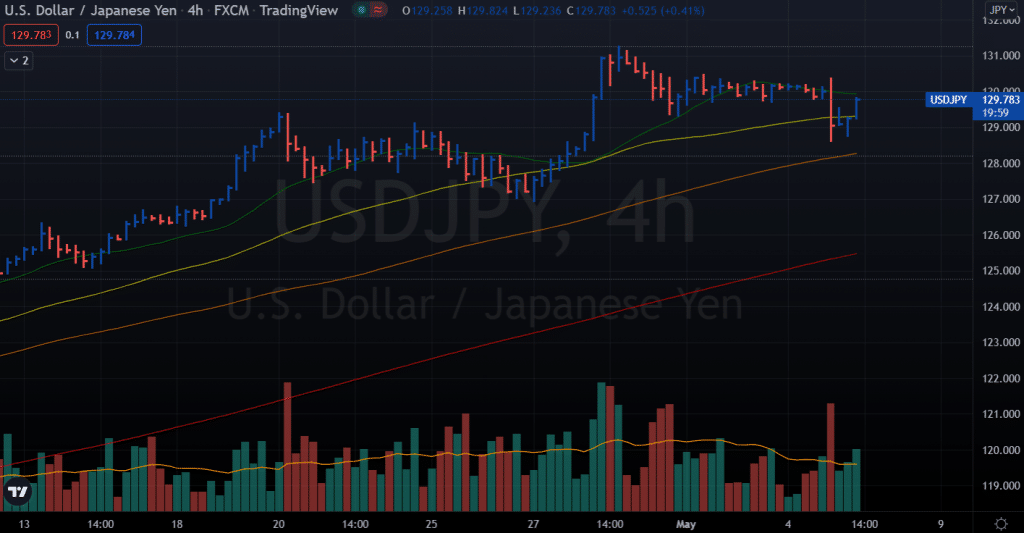

The USD/JPY price rose steadily throughout the day, reaching new daily highs around 129.75 at the start of the European session.

–Are you interested in learning more about spread betting brokers? Check our detailed guide-

On Thursday, the pair attracted fresh buying, and it has now recovered over 100 pips from a daily low near 128.75. A combination of factors allowed spot prices to reverse from the previous day’s lull after the Fed meeting to a weekly low.

Generally, positive sentiment in European stock markets undermined the Japanese yen’s status as a safe-haven currency. Furthermore, the Fed and the Bank of Japan diverged significantly on monetary policy, which led to a stronger dollar/yen amid renewed demand for the dollar.

On Wednesday, Fed Chairman Jerome Powell said that policymakers are ready to raise interest rates by 50 basis points at upcoming meetings. However, he downplayed the possibility of a more aggressive policy tightening. By 2022, prices will still factor in a 200-basis point rate hike.

The FOMC is expected to rise 50 basis points each meeting over the next four meetings. The US Treasury yields began to rise again due to this, which helped the dollar recover from a weekly low set earlier this Thursday and gave the USD/JPY pair a boost.

The BOJ, on the other hand, promises to maintain its ultra-loose monetary policy and conduct unlimited asset purchases to protect its “near-zero” 10-year yield target. The USD/JPY pair benefited from this further deflection of flows away from the JPY. Moreover, in light of the recent corrective pullback from a two-decade high, the fundamentals are bullish. Thus, a further recovery over the psychological level of 130.00 remains quite possible.

What’s next to watch?

Later in the early North American session, the weekly jobless claims will be released as part of the US economic calendar. In addition to US bond yields, this will affect the price of US dollars and give USD/JPY some gains. However, to take advantage of short-term opportunities, traders will continue to consider broader market risk attitudes.

–Are you interested in learning more about Australian brokers? Check our detailed guide-

USD/JPY price technical analysis: More gains ahead

The USD/JPY price is wobbling around a 20-period SMA below the 130.00 mark. The pair seems positive to test the previous highs as the volume for the recent three up bars is rising. Moreover, the pair managed to get back above the 50-period SMA on the 4-hour chart. Breaking the previous highs above the 131.00 mark will open the path towards 135.00.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money