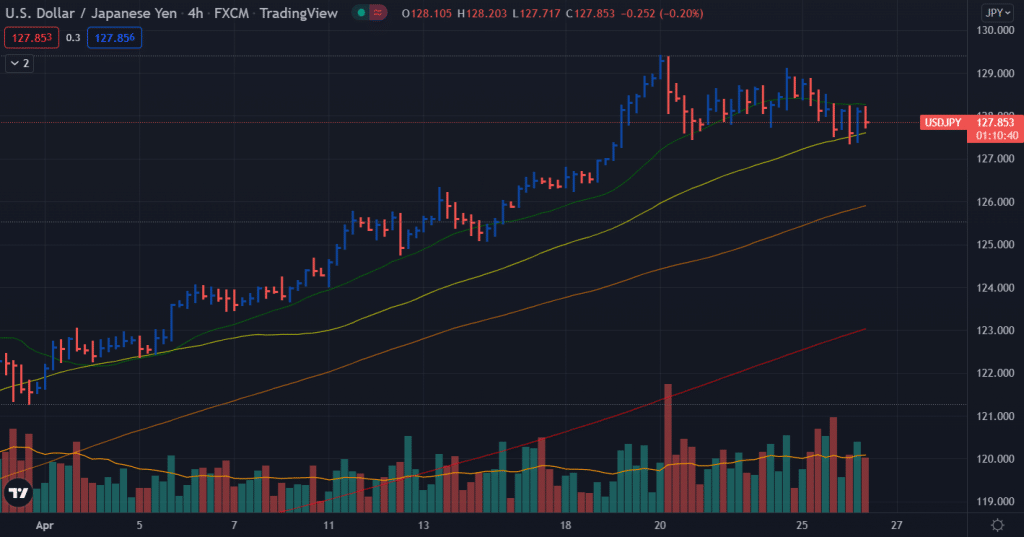

- Shortly after Japan’s unemployment rate was announced, USD/JPY declined vertically.

- The Japanese yen was supported by a lower-than-expected unemployment rate of 2.6%.

- Due to extremely overbought positions, DXY faced headwinds.

After the Japan Bureau of Statistics released employment data of 2.6%, lower than expected and previously released at 2.7%, the USD/JPY price fell to near 127.35.

–Are you interested in learning more about Canadian forex brokers? Check our detailed guide-

Japanese unemployment rate

The US stocks market fell after the employment statistics were released. The Japanese yen gained against the U.S. dollar due to improvements in the labor market. Furthermore, the vacancy/applicant ratio reached 1.22, slightly higher than the previous 1.21% and in line with market expectations.

Dovish BoJ

There has been an intense sell-off at the counter due to an extremely tight job market in Japan. Globally, the Japanese yen is on an uptrend after a prolonged decline due to ultra-loose monetary policy. While the economy has not recovered to pre-pandemic levels, the Bank of Japan remains dovish regarding its liquidity status. As a result, the asset is being pulled lower by profit-taking, but the long-term bullish sentiment remains unchanged.

Fed’s aggression and rising yields

The U.S. Dollar Index (DXY) faces resistance as it attempts to scale 102.00. In response to the momentum oscillators appearing extremely overbought for multiple periods, DXY faced a slight headwind. Fed rate hike expectations have consistently kept bulls on top as part of monetary policy in May. As a result, for the first time in three years, the U.S. 10-year Treasury note yield failed to rise by more than 3%.

USD/JPY price technical analysis: Bears eying 100-SMA

The USD/JPY price recovered from the daily lows of 127.35. However, the gains remain capped after breaking the 20-period SMA (4-hour chart). Although the pair has been supported by the 50-period SMA, the price action ranges between 20 and 50 SMAs.

–Are you interested in learning more about high leveraged brokers? Check our detailed guide-

If the bears prevail, the next target on the downside will be around 100-period SMA near the 126.00 region. However, the volume data does not endorse this scenario at the moment. The previous price bar closed near the highs with a very high volume. This shows the resilience of the pair to go down. However, after a prolonged bullish trend, a downside correction is due.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money