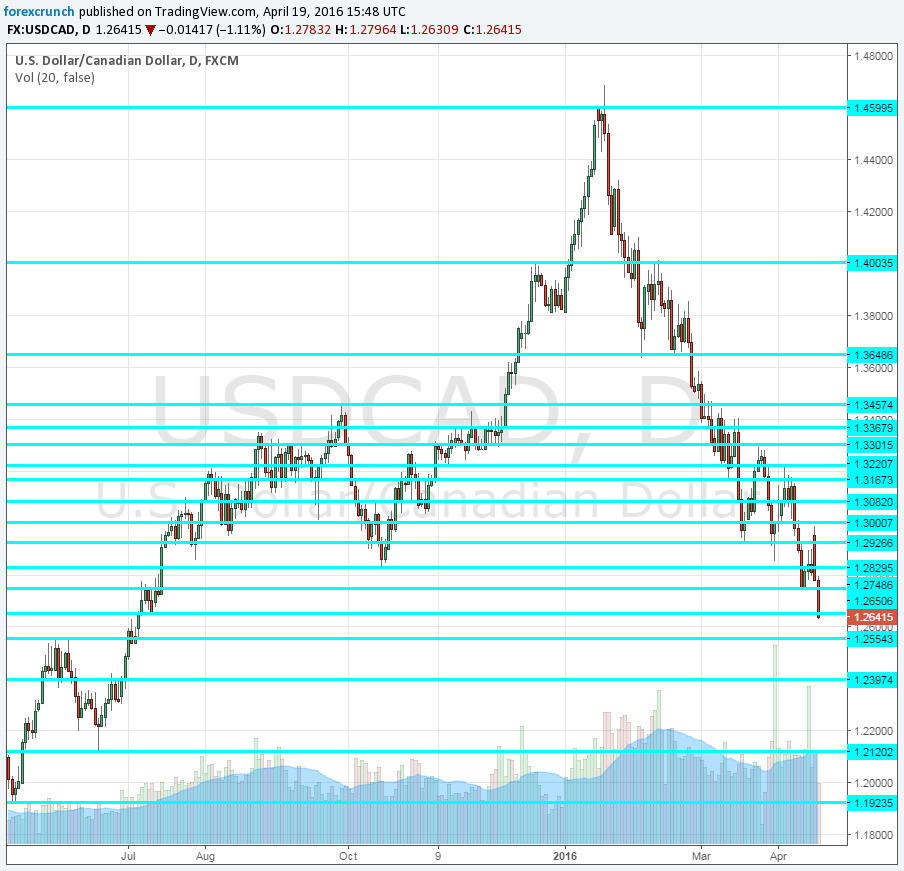

The Canadian dollar keeps powering on, with USD/CAD reaching a low of 1.2630 trading at levels last seen in July 2015 and already more than 2000 pips below the peak seen in January.

What’s going on? Where is the bottom?

USD/CAD rises because:

- Doha Disappointment: After OPEC and Non-OPEC members failed to reach an agreement, oil prices fell but quickly rebounded: taking a profit as well as a strike in Kuwait are behind the bounce. So far, WTI Crude Oil managed to climb above $40 and in the recent move, it climbed above $41, as an extension. CAD followed with its own extension. The API report today and the EIA one tomorrow are up next. These weekly events will also have their impact. Note that at least on WTI, we are still under the highs of $42.42 seen earlier this month.

- Upbeat BOC: Continuing on the stance from last week’s rate decision, Governor Stephen Poloz of the BOC provides some optimism. He says that the output gap will likely close in the latter part of 2017 and that the economic data have been positive. However, the head of the central bank also warns about the global economy and the lack of investment. These, especially worries about the global economy, are currently ignored. He also said that fiscal action would have more power than monetary action now and that the there is no need for further action at the moment.

- Weak US data: Earlier today, both housing figures in the US came out worse than expected at 1.09. Usually we get housing starts going positive and building permits going negative, but this time both went to the wrong side and added to the misery of the greenback, that was already down.

USD/CAD levels

The Canadian dollar has lost the 1.2750 level that supported it during the month of April. It already made a first attempt to drop below 1.2640, which provided support to the pair back in July 2015.

Below this level we find 1.2560, which capped the pair back in June of last year. This is followed by the round level of 1.24: the level worked as support back in June before capping the pair in July.

The next line of support is much lower: 1.2120: a swing low back in June and a cap in May. Even lower, below 1.20, we have support at 1.1924.

On the topside, 1.2750 now works as resistance, followed by 1.2830 which remains a strong line after serving as a double top in the second half of 2015. 1.2930 is the last line before 1.30.