The Canadian dollar managed to gain against the greenback on the European hopes. Rate decision and housing data are the main market-movers this week. Here’s an outlook for the Canadian events and an updated technical analysis for USD/CAD.

Last week was less optimistic for the Canadian economy with lower than forecasted GDP figures indicating slower growth of 0.2% and disappointing employment readings showing Canada lost 18,600 jobs instead of the 18,100 addition anticipated and rising unemployment rate reaching 7.4%. Is Canada losing its momentum?

Updates: US weakness in the services sector didn’t stop the strengthening Canadian dollar, that enjoyed the Merkozy declaration, at least for now. The Canadian dollar remains range bound. It weakened on the threat to downgrade all euro-zone nations, but still awaits the rate decision in Canada, due soon. See how to trade the Ivey PMI with USD/CAD. Ivey PMI advanced to 59.9 and this got USD/CAD closer to parity. Headwinds are found in the European problems. A disappointment from Canadian housing starts (only 181K) and NHPI (only +0.2%) added to the misery that came from the ECB disappointment. The Canadian dollar is lower. USD/CAD leaped from 1.0060 to 1.02. The weak EU summit sent the pair higher to resistance at 1.0263 before retreating.

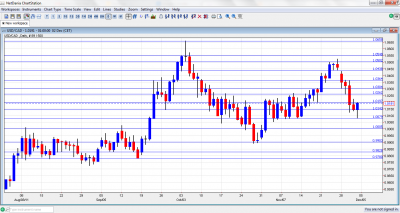

USD/CAD daily chart with support and resistance lines on it. Click to enlarge:

- Building Permits: Tuesday, 13:30. The value of Canadian building permits dropped 4.9% in September following a decrease of 10.1% in August. This unexpected decline was well below the 2.7% increase expected. Major drops occurred inBritish Columbia andAlberta. A climb of 3.2% is expected.

- Rate decision: Tuesday, 14:00. The Bank of Canada maintained its overnight rate at 1.0% in light of the global economic slowdown, and financial market volatility. The BOC predicts growth moderation inCanada until mid-2012 but will return to growth by the end of 2013. No Change is forecasted.

- Ivey PMI: Tuesday, 15:00. Purchasing activity declined in October reaching 54.4 from55.7 in September. Economists predicted a reading of 55.7. The index is still indicating expansion but market activity is slowing down. A rise to 55.1 is predicted.

- Housing Starts: Thursday, 13:15. The number of housing starts dropped to 207,600 units in October after 208,800 units in September. The drop was above the 198,000 predicted indicating a slowdown in the housing industry. A drop to 203,000 is forecasted.

- NHPI : Thursday, 13:30. New home prices edged up by 0.2% in September rising for the sixth consecutive month. The increase in prices was in line with economists predictions. The main increase was in eight metropolitan regions. An increase of 0.5% is expected now.

- Trade Balance: Friday, 13:30.Canada’s trade balance flipped from deficit to a $1.2-billion surplus amid 4.2% climb in exports while economists expected another deficit of $500 million. The main cause for the rise in exports was a 5.6% increase in auto shipments. Surplus is expected to narrow to $0.8 million.

- Labor Productivity: Friday, 13:30. Canadian businesses productivity dropped in October to the lowest reading in five years decreasing 0.9% after 0.4% gain in the previous month. The main cause for the sharp decline was reduced business output rather than labor factors. A rise of 0.4% is predicted.

* All times are GMT.

USD/CAD Technical Analysis

Dollar/CAD started the week with range trading between the 1.0263 and 1.0360 lines (mentioned last week), before the pair fell sharply lower. After hitting 1.0080, the pair recovered and closed at 1.0191, just under the 1.02 line.

Technical lines, from top to bottom:

1.0677 is a veteran and distinct resistance line, which worked well in October and also in the past and remains of high importance. 1.0550 is a minor line on the way up.

1.0500 is another minor line of resistance. It was a pivotal around the same time and was a point of resistance before the pair fell. 1.0440 joins the chart after providing support once the pair hit high ground.

1.0360 capped the pair in September and October and also provided support. The round number of 1.03 was the peak of a move upwards seen in November.

1.0263 is the peak of recent surges during October and also November but has a weaker role now. The round figure of 1.02 was a cushion when the pair dropped in November, and also the 2009 trough. This is a pivotal line now.

1.0143 was a swing low in September and worked as resistance in the past. It capped a small recovery attempt in November. 1.0070 worked as support in November and had the opposite role back in 2010. It worked as a great cushion for the pair in November.

The very round number of USD/CAD parity is a clear line of course, and it will be closely watched on a potential downfall. Under parity, the round number of 0.99 provided support on a fall during October and also served as resistance back in June.

0.9830 provided support for the pair during September. 0.9780, where the current run began is the next and important support line.

I am neutral on USD/CAD.

On one hand, Canadian figures, and especially another disappointing job report, are week. In addition, the European debt crisis casts a dark shadow over the global economy. On the other hand, the improved situation in the US, together with higher oil prices, both support the Canadian dollar.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the New Zealand dollar (kiwi), read the NZD forecast.

- For the Swiss Franc, see the USD/CHF forecast.

- USD/CAD (loonie), check out the Canadian dollar.