The Japanese yen posted sharp gains last week, gaining 150 points. USD/JPY closed at 112.43. There are four events on the calendar. Here is an outlook for the highlights of this week and an updated technical analysis for USD/JPY.

In the US, retail sales and CPI were better than expected and also Yellen sounded upbeat about the US economy. Japanese Preliminary GDP posted a small gain of 0.2%, short of the estimate of 0.3%.

Updates:

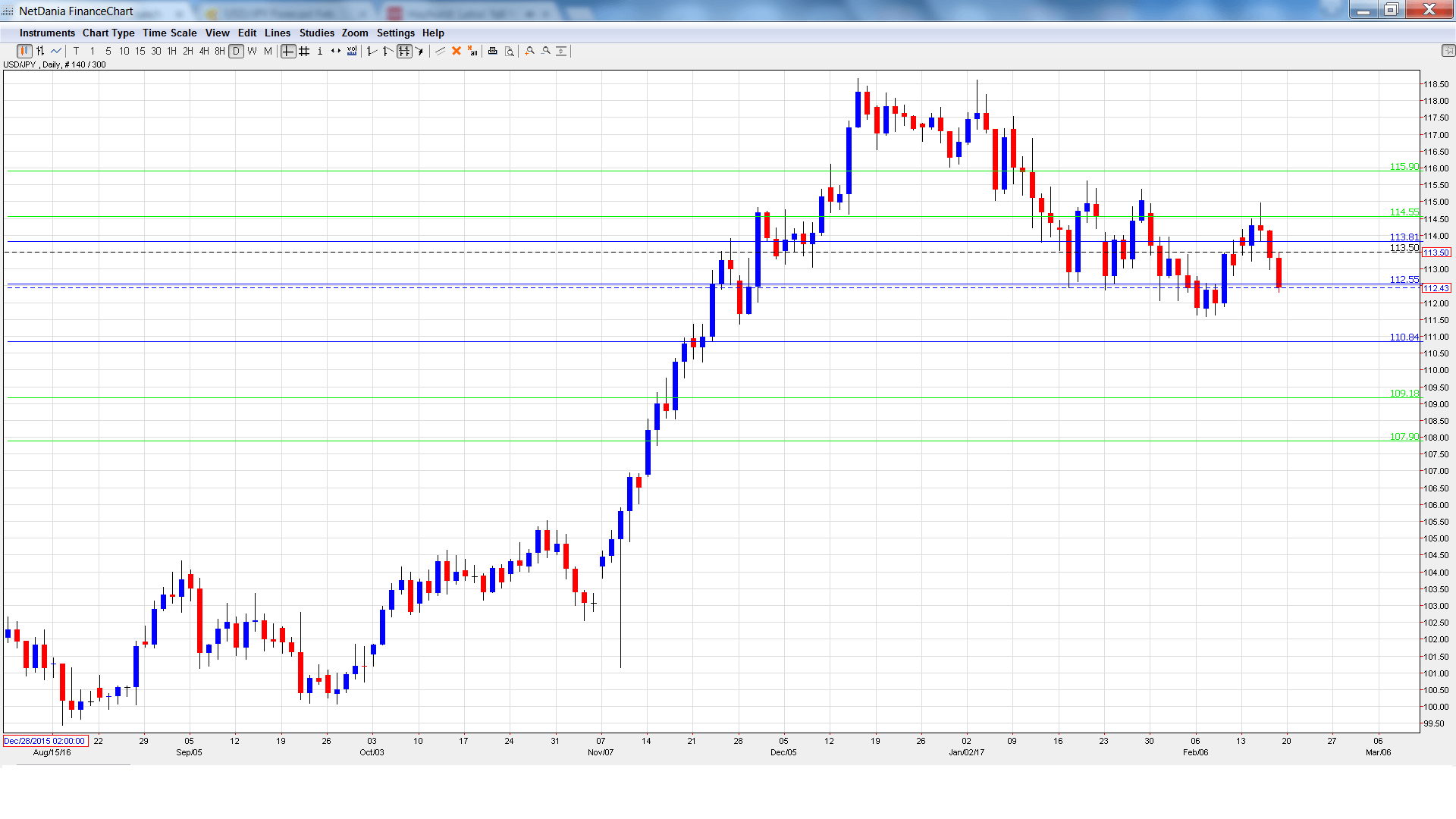

USD/JPY graph with support and resistance lines on it. Click to enlarge:

- Trade Balance: Sunday, 23:50. Japan’s surplus narrowed to JPY 0.36 trillion in December, but this beat the forecast of JPY 0.22 trillion. The downward trend is expected to continue in January, with an estimate of JPY 0.28 trillion.

- Flash Manufacturing PMI: Tuesday, 00:30. The PMI improved to 52.8 in January, pointing to expansion in the manufacturing sector. The index is expected to dip to 52.1 in February.

- All Industries Activity: Tuesday, 4:30. This indicator helps analysts track the strength of the business sector. In November, the indicator edged up 0.3%, close to the forecast of 0.4%. The markets are braced for a decline of 0.2% in the December report.

- SPPI: Wednesday, 23:50. This corporate inflation index rose 0.4% in December, matching the forecast. Another gain of 0.4% is expected in January.

USD/JPY opened the week at 113.93 and climbed to a high of 114.96. The pair then reversed directions and dropped to a low of 112.31, testing support at 112.53 (discussed last week). USD/JPY closed the week at 112.43.

Live chart of USD/JPY:

Technical lines from top to bottom:

We start with resistance at 115.90.

114.55 marked a high point in March 2015.

113.80 has switched to a resistance role following sharp losses by USD/JPY.

112.53 was a cap in April 2016.

110.83 is next.

109.18 marked the start of a rally in September 2008 which saw USD/JPY drop close to the 0.87 level.

107.90 is the final support level for now.

I am bullish on USD/JPY

Janet Yellen presented lawmakers with a positive assessment of the US economy, and strongly hinted that another rate hike is coming in the first half of 2017. So, monetary divergence favors the greenback.

Our latest podcast is titled Oil upside and euro underperformance

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast.