AUD/USD was marked by strong volatility, but posted only minor gains for the week. The pair closed at 0.7593. This week has just four events on the calendar. Here is an outlook on the major market-movers and an updated technical analysis for AUD/USD.

The Federal Reserve was very dovish in its policy statement, sending AUD/USD to higher levels. Australian Employment Change slipped to just 0.3 thousand, well below expectations.

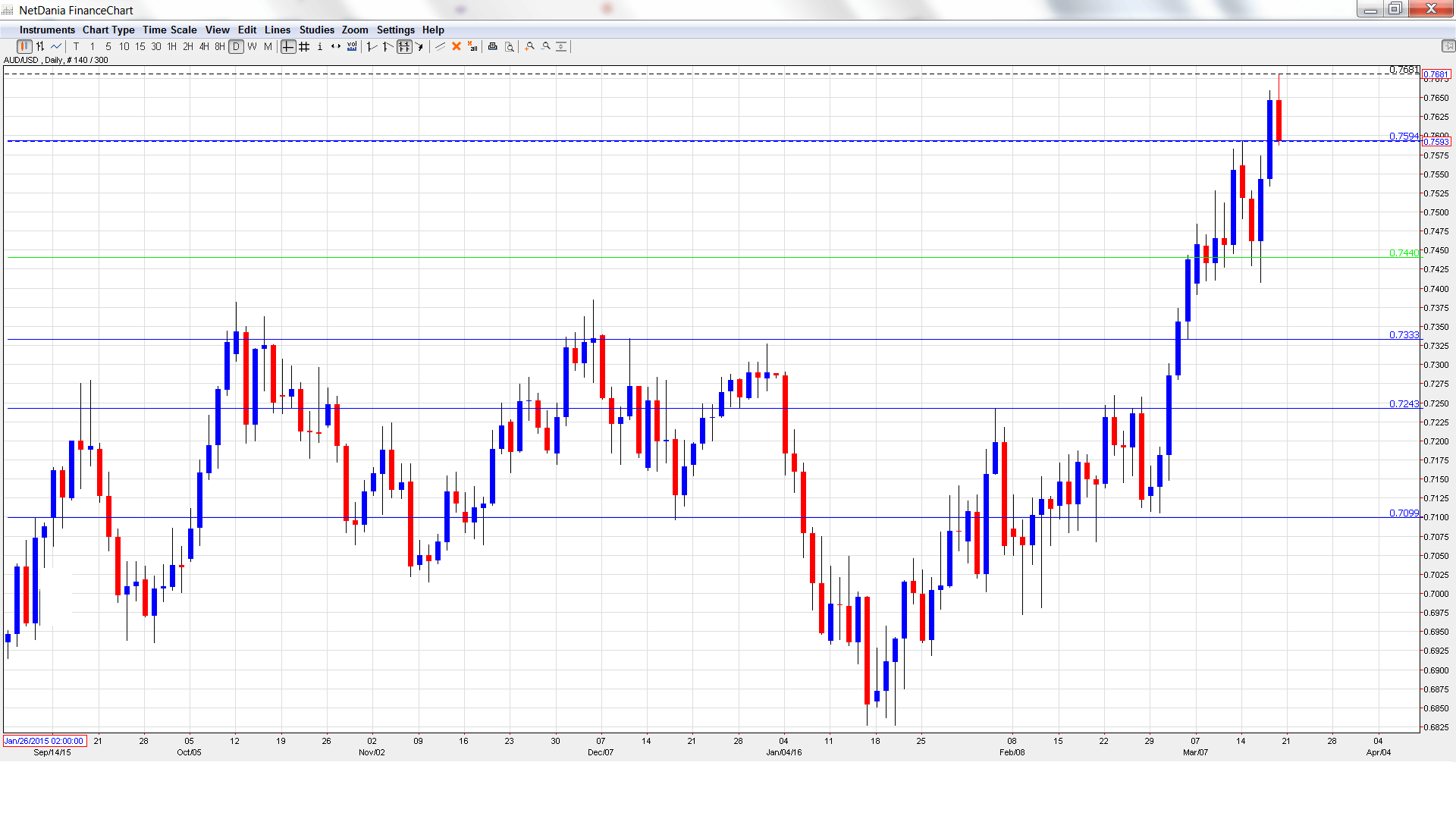

[do action=”autoupdate” tag=”AUDUSDUpdate”/]AUD/USD graph with support and resistance lines on it. Click to enlarge:

- CB Leading Index: Monday, 14:30. This minor event has struggled, posting 4 declines in the past 5 months. Will the index climb back into positive territory in the January report?

- Australian HPI: Tuesday, 00:30. This housing inflation indicator gauges the health of the Australian housing market. It is released each quarter, magnifying the significance of each release. The index softened to 2.0% in Q3, within expectations. The markets are braced for a negligible reading of 0.1% in Q4.

- RBA Assistant Governor Malcolm Edey Speaks: Tuesday, 00:45. Edey will address a financial forum in Sydney. A speech which is more hawkish than expected could push the Aussie upwards.

- RBA Governor Glenn Stevens: Tuesday, 5:30. Stevens will deliver remarks at a financial forum in Sydney. Analysts will be looking for clues as to the RBA’s future monetary policy.

* All times are GMT

AUD/USD Technical Analysis

AUD/USD started the week at 0.7561 and dropped to a low of 0.7408, testing support at 0.7438 (discussed last week). AUD/USD then reversed directions and climbed to a high of 0.7681. The pair was unable to consolidate at these levels and retracted, closing the week at 0.7593.

Live chart of AUD/USD: [do action=”tradingviews” pair=”AUDUSD” interval=”60″/]

Technical lines from top to bottom:

We begin with resistance at 0.8025, which is protecting the symbolic 0.80 level.

0.7886 was last breached in late May.

0.7798 was an important resistance level for much of June.

0.7692 is next.

0.7597 is protecting the 0.76 line.

0.7438 has strengthened in support.

0.7334 was a cap in mid-December.

0.7243 is next.

The round number of 0.71 is the final support level for now.

I am neutral on AUD/USD

The Fed statement was very cautious about the US economy, and the Fed has downgraded its rate hike projection to just two times in 2016. Still, recent numbers have been solid, and if inflation picks up, we’re sure to hear increased speculation about a rate hike this summer.

In our latest podcast we digest the dovish Fed

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Canadian dollar (loonie), check out the Canadian dollar forecast.

- For the kiwi, see the NZD/USD forecast