The former leader of UKIP, Nigel Farage, wanted to make June 23rd a holiday to celebrate “Independence Day”. There are no big celebrations. One year after the Brexit Referendum, some of the top politicians have changed, but uncertainty about the future is the same. Brexit negotiations have begun this only this week and they have the work cut out for them.

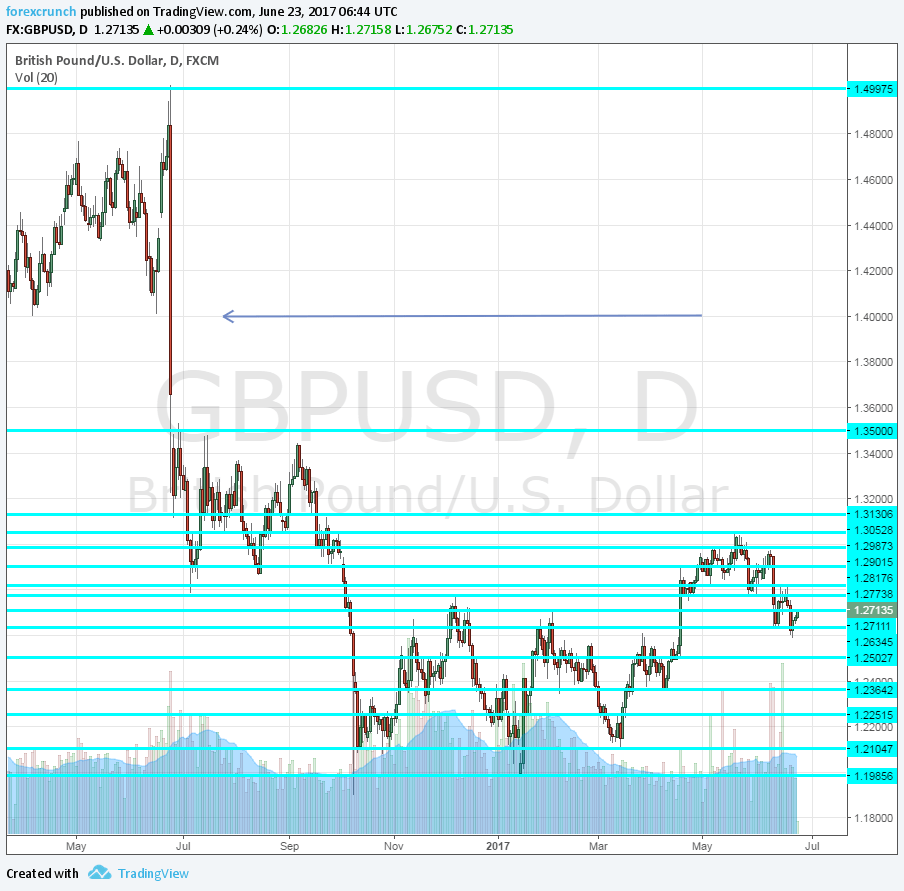

The fall in the pound hasn’t changed either. GBP/USD had a nasty hangover from the vote, rising from around 1.47 to just under 1.50 only to crash all the way down to 1.3225 before settling at 1.3660.

During the summer, the pair traded in a range between 1.28 to 1.35. Theresa May took over as Prime Minister from David Cameron and uncertainty about the economy and the Brexit details such as the triggering of Article 50 kept volatility high.

The Bank of England stepped in to support the economy which seemed weak at first, but the economy did not need too much support GDP continued growing at a robust pace throughout 2016

Second leg down on a hard Brexit

In October, we began getting the notion that May’s government is going for a Hard Brexit: preferring a limit on immigration and willing to forego the UK’s participation in the single market.

The fall in the pound was exacerbated by a huge “flash crash” that took GBP/USD from 1.2650 to under 1.20 within seconds. The pair then traded in a lower range. May’s Brexit speech in January confirmed the hard Brexit and kept Sterling depressed.

The 1.20 to 1.28 range followed the previous 1.28-1.35 range. Signs of stress began appearing in the economy. The weakness of the pound resulted in higher prices. As wages got stuck, standards of living fell and growth suffered from early 2017.

May triggered Article 50 on March 29th, setting the countdown clock for the EU exit, with or without an agreement, on March 29th, 2019. The reaction was muted on the expected move, but not for long.

Election action

In April, Theresa May announced a snap election and sent GBP/USD back to the initial pre-Brexit range. The pair topped 1.30 on hopes for a softer Brexit, assuming she would win a big majority and diminish the strength of the Brexiteers.

The election did not work out the way she wanted, with the Tories losing their majority. While the pound dropped, it did not collapse this time, as the narrative changed: perhaps the hung parliament could somehow result in a softer Brexit and amid contradicting statements from the BOE.

What’s next? The level of uncertainty about Brexit negotiations is high and so is the political uncertainty in the UK.

In the meantime, let’s see the moves on the chart: