EUR/USD managed to recover as November began. Updated EU forecasts and some German data stand out, as Americans go to the polls. Volatility is going to be high. Here is an outlook for the highlights of this week and an updated technical analysis for EUR/USD.

Euro-zone inflation remains subdued. Despite a rise in the headline CPI, core inflation did not budge, causing a headache for the ECB. GDP growth was OK as 0.3%, but also failed to excite. In the US, the FED and the NFP had their word ahead of the elections. Clinton remains in the lead, albeit a narrower one, due to the FBI Effect. The US Non-Farm Payrolls were quite upbeat, with the biggest gain in wages since 2009, but markets focus on the elections.

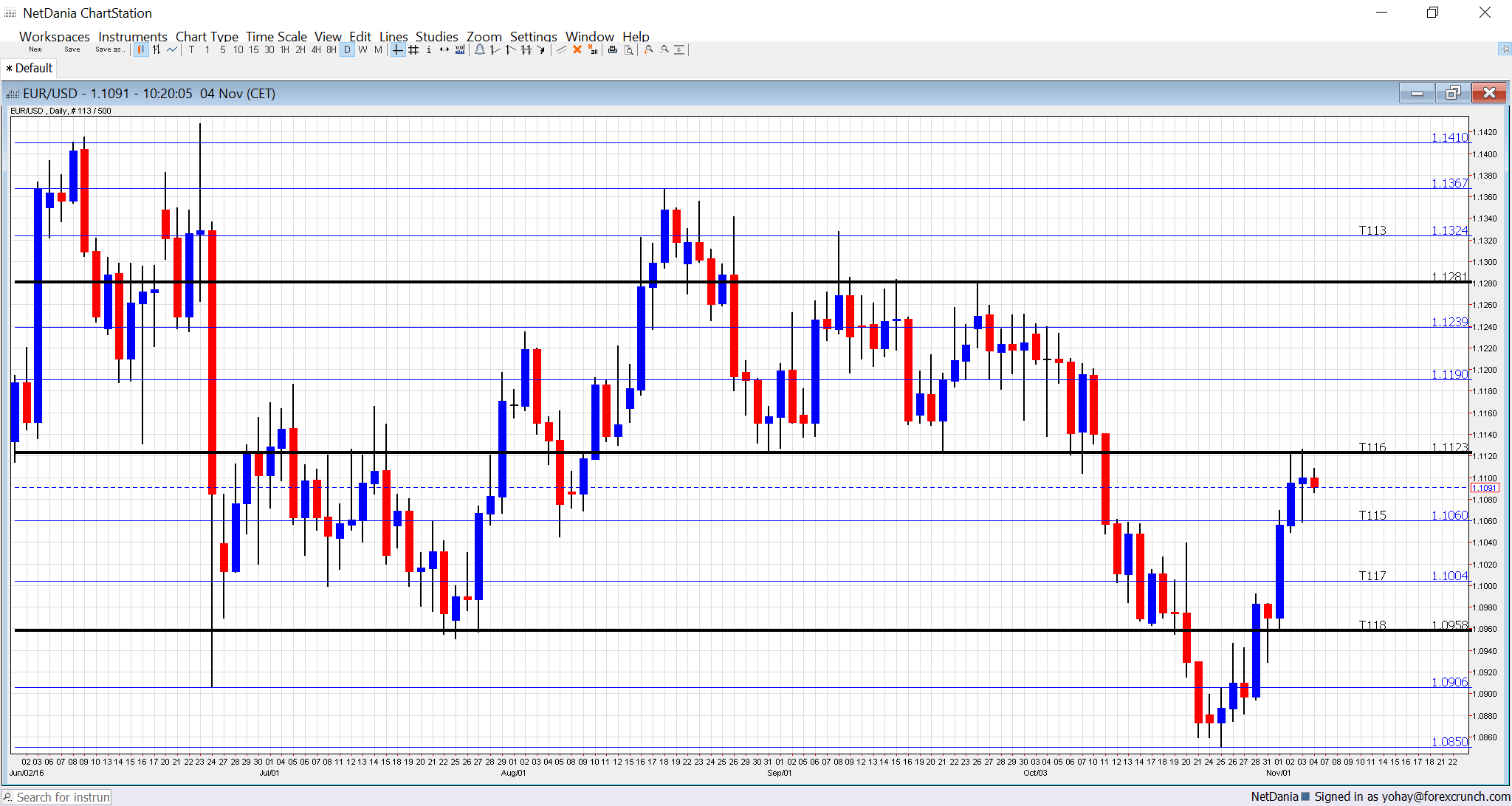

[do action=”autoupdate” tag=”EURUSDUpdate”/]EUR/USD daily graph with support and resistance lines on it. Click to enlarge:

- Eurogroup meetings: Monday, with the wider Ecofin on Tuesday. European finance ministers convene to discuss business. In the euro-zone, Greece still has its issues. Spain has finally formed a new government but hasn’t changed the finance minister, which will be asked to align with policy measures coming out of Brussels. The wider issue of Brexit is also on the agenda, with the recent twist of the court ruling which could delay the process. Comments come out throughout the day.

- German Factory Orders: Monday, 7:00. The euro-zone’s locomotive has enjoyed an increase of 1% in orders at factories back in August. We now get the numbers for September in this volatile indicator. A rise of 0.2% is on the cards.

- Retail PMI: Monday, 9:10. Markit’s purchasing managers’ index for the retail sector stood on 49.6 points in September, just under the 50 point threshold separating growth and contraction. A similar figure is likely now.

- Sentix Investor Confidence: Monday, 9:30. This 2800-strong survey has beat expectations in the past three months, hitting 8.5 points in October. A tick up to 8.7 is on the cards.

- Retail Sales: Monday, 10:00. The indicator is released after major economies had already released their own measures. Nevertheless, it still has a significant impact. A drop of 0.1% was recorded last time. A slide of 0.3% is expected.

- US elections: Tuesday, with the first results coming on Wednesday at 00:00 GMT and into the early hours of the morning. Markets usually prefer Republican pro-business, pro-market presidents, but Donald Trump is a different kind of candidate. The self-proclaimed billionaire is seen as extremely erratic and anti-trade. His rival, Hillary Clinton, is unexciting but cannot be characterized as anti-market per-se. Fear of a Trump victory hurt the US dollar while better chances for a Clinton victory helped the greenback. The race has tightened recently, pushing the dollar lower against the euro, but the euro is not a classic safe-haven currency, therefore it could join commodity currencies in losing and not the yen in winning upon a Trump victory. A Clinton victory is not fully priced in, but the reaction will not be as strong as a Trump victory. US elections and forex – all the updates

- German Industrial Production: Tuesday, 7:00. Industrial output in the continent’s largest economy advanced by 2.5% back in August. The month of September could see a swing back down. A slide of 0.4% is predicted.

- German Trade Balance: Tuesday, 7:00. Germany’s huge trade surplus keeps the euro bid. A surplus of 22.2 billion euros was recorded in August. A similar figure could be seen now. A wider surplus of 23.4 billion euros is on the cards.

- French Trade Balance: Tuesday, 7:45. Contrary to Germany, France has a deficit. This stood on 4.3 billion in August and isn’t expected to materially change this time. The French government balance is released at the same time and has less of an impact. A more narrow deficit of 4.1 billion euros is projected.

- EU Economic Forecasts: Wednesday, 10:00. The European Commission releases updated forecasts three times a year. The economies of the euro area continue growing, but at a mediocre pace, 0.3% q/q according to the most recent figures. We will get updated data from 2017 and 2018.

- French Industrial Production: Thursday, 7:45. France enjoyed a big jump in industrial output back in August, 2.1%. A correction could come now but economists expect +0.3%.

- German inflation data: Friday, 7:00. This is the final read of CPI and feeds into the final CPI for the whole euro-zone. The preliminary read of 0.2% m/m will likely be confirmed now. The Wholesale Price Index (WPI) is expected to rise by 0.2% after 0.4% last time.

* All times are GMT

EUR/USD Technical Analysis

Euro/dollar was moving up, challenging the 1.1125 level (mentioned last week).

Technical lines from top to bottom:

1.1335 worked as the lower bound of a higher range and then capped recovery attempts in May. 1.1230 capped the pair after the fall in May and worked as resistance.

1.1190 is the post-Brexit high seen in July. 1.1125 cushioned the pair in early September. 1.1070 served as a clear separator of ranges during February and also beforehand.

1.10 is a round number and significant resistance. 1.0960, which supported the pair in early 2016 worked as resistance in October. 1.0850, which worked as support during the same month, serves as support.

The post-Draghi low 1.0780 replaces 1.08 as support. 1.0710 is the next support line on the chart after temporarily capping the pair in April 2015.

Further below, the 2016 low of 1.0520 and the 2015 low of 1.0460 provide further support.

I am bearish on EUR/USD

The fundamentals continue pointing to the downside, as the ECB is set to add easing while the FED is on course to raise rates in December. One factor that can derail a hike is a victory for Donald Trump. Such an event could also be dollar-positive, on safe haven flows that will benefit the greenback. All in all, it’s a win-win week for the greenback.

More:

- How to trade the US elections with currencies

- US elections: updates on 21 brokers

- US elections and forex – all the updates in one place

And the video:

Our latest podcast is titled Bold in oil and talking up the currency

Follow us on Sticher or iTunes

Safe trading!