GBP/USD posted moderate losses last week, erasing the gains from the previous week. This week features four events, including GDP. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

The Bank of England remained in neutral gear, maintaining the Official Bank Rate at 0.25%, as expected. There was no change to QE, which stayed at 645 billion pounds for a third straight release. The services sector is in free-fall, as the Services PMI slipped to 13.4 in April, down sharply from 34.5 a month earlier. There was no relief from the construction industry, as Construction PMI slowed to 8.2, down from 39.3 points.

In the U.S., factory orders fell by 10.3% in March, after a flat 0.0% reading a month earlier. Employment numbers for April were dismal. Unemployment claims came in at 3.16 million, down from 3.8 million a week earlier. This brings the running total to a staggering 33.4 million. Nonfarm payrolls dropped by a record 20.5 million in April, slightly below the estimate of 22.4 million. The unemployment rate jumped to 14.7%, up from 4.4% a month earlier. Still, this beat the forecast of 16.0 percent. There was some good news, as wage growth shot up 4.7%, crushing the estimate of 0.5 percent.

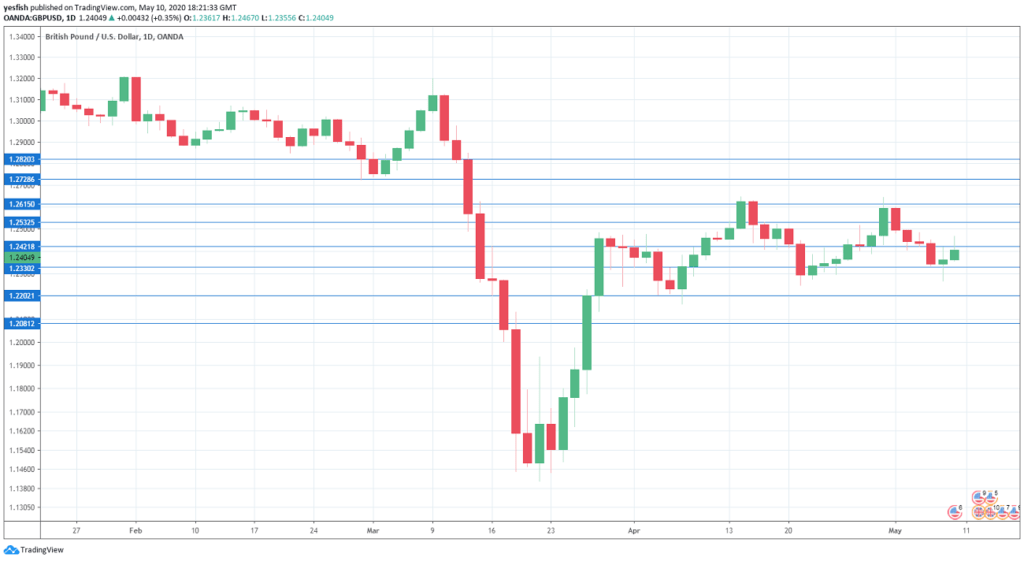

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- BRC Retail Sales Monitor: Tuesday, 23:01. The British Retail Consortium’s measure of retail sales has sputtered, with only one gain in the past five months. The indicator declined by 3.5% in March, but this was better than the forecast of -5.5 percent. The April forecast stands at -15.0 percent.

- GDP: Wednesday, 4:30. The quarterly GDP reading for Q4 in 2019 slowed to 0.0%, down from 0.3% in the previous quarter. Analysts are braced for a contraction of 2.5% in Q1 of 2020. Monthly GDP showed that the economy contracted by 0.1% in February, and the estimate for March stands at a staggering -7.9%, as Covid-19 is expected to have caused a huge jolt to the British economy.

- Manufacturing Production: Wednesday, 4:30. The indicator accelerated to 0.5% in February, up from 0.2% a month earlier. March is expected to be a disaster, with a forecast of -6.0 percent.

- RICS House Price Balance: Wednesday, 19:01. The Royal Institution of Chartered Surveyors indicator slipped to 11% in March, after a strong reading of 29% in February. The housing market is in trouble, and the estimate for March stands at -25 percent.

Technical lines from top to bottom:

We start with resistance at 1.2820.

1.2728 has held in resistance since early March. 1.2616 is next.

1.2535 has strengthened in resistance following losses by GBP/USD last week.

1.2420 (mentioned last week) is an immediate resistance line. It could see action early next week.

1.2330 is providing support.

The round number of 1.22 has provided support since the first week in April.

1.2080 is protecting the symbolic 1.20 level. It is the final support line for now.

I remain bearish on GBP/USD

Corvid-19 has sent the manufacturing and services industries reeling, and first-quarter GDP is projected to show that the UK economy is contracting. The U.S. dollar remains a safe haven for jittery investors, which could mean trouble for the British pound.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!