GBP/USD posted sharp losses of 180 points last week, as the pair closed the week at 1.4419. This week is busy, with 13 events on the schedule. Here is an outlook on the major events moving the pound and an updated technical analysis for GBP/USD.

The pound lost ground last week, as all three UK PMIs missed their estimates. In the US, Nonfarm Payrolls was dismal, falling to 160 thousand, well below expectations.

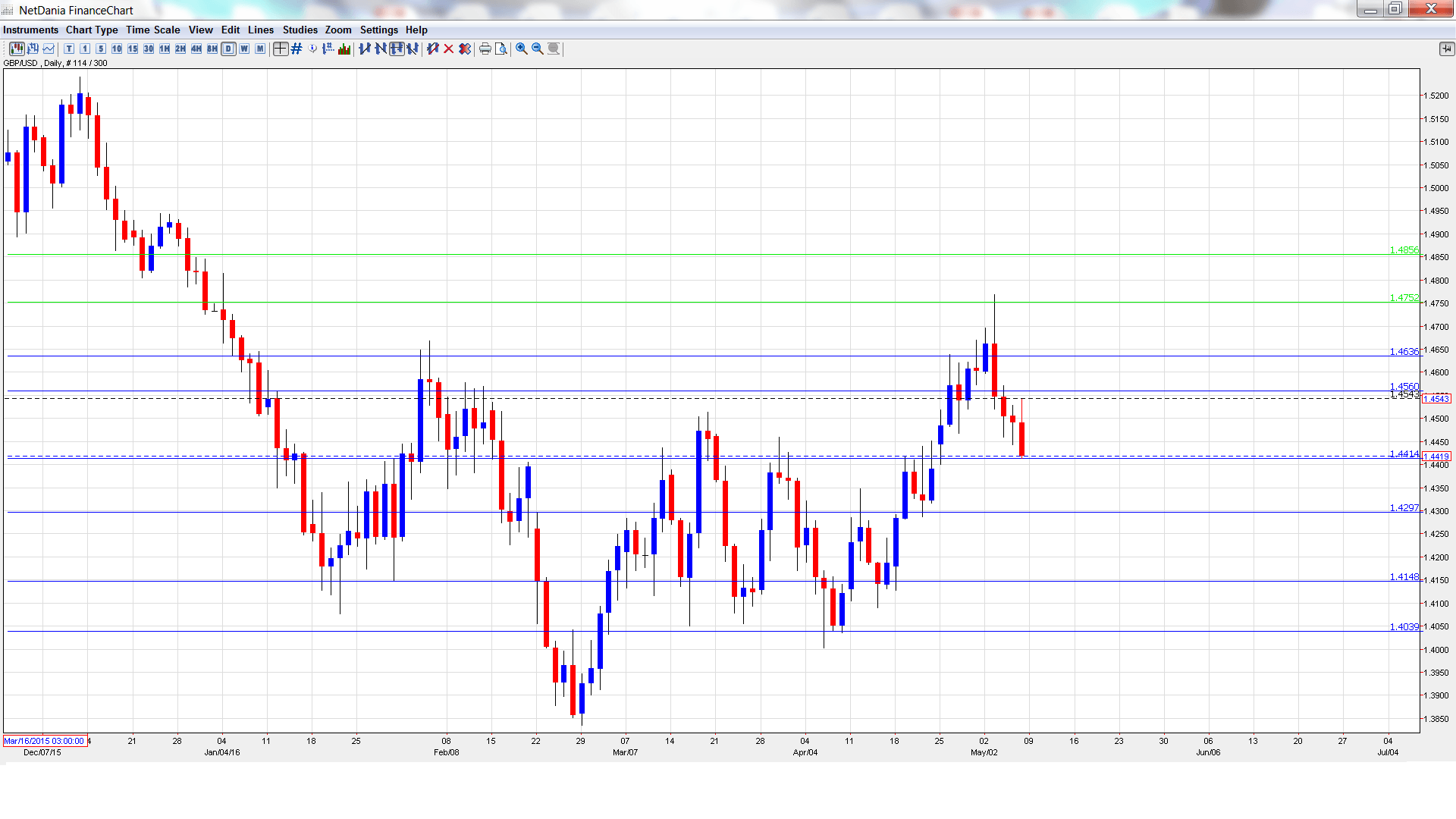

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- Halifax HPI: Monday, 7:30. This housing inflation indicator provides a snapshot of the level of activity in the housing sector. The index bounced back in March, posting a strong gain of 2.6%, well above expectations. The forecast for the April report stands at 0.1%.

- BRC Retail Sales Monitor: Tuesday, 23:01. This indicator measures retail sales in BRC shops. The indicator posted a decline of 0.7% in March, marking a 7-month high. Will the indicator reverse directions in April?

- Goods Trade Balance: Tuesday, 8:30. The UK trade deficit widened to GBP -12.0 billion, higher than the estimate of GBP -10.3 billion. Better news is expected in the March report, with an estimate of GBP -11.2 billion.

- Manufacturing Production: Wednesday, 8:30. Manufacturing Production is the first key event of the week. The indicator continues to post declines, and dropped 1.1% in February, worse than the estimate of -0.2%. The markets are expecting better news in March, with an estimate of 0.4%.

- NIESR GDP Estimate: Wednesday, 14:00. This monthly indicator helps analysts track GDP, which is released every quarter. The indicator has been steady, posting two consecutive gains of 0.3%.

- RICS House Price Balance: Wednesday, 23:01. This housing indicator dipped to 42% in March, short of the forecast of 50%. The downward trend is expected to continue in April, with an estimate of 38%.

- BOE Inflation Report: Thursday, 11:00. This report is issued every quarter. With inflation levels at very low levels, the markets will be combing through the report, and a dovish report could send the pound downwards. A press conference hosted by BOE Governor Mark Carney will follow.

- Monetary Policy Summary: Thursday, 11:00. This monthly summary contains details of the BoE’s view of the economy. Analysts will be looking for clues as to the BOE’s future monetary policy.

- Official Bank Rate: Thursday, 11:00. The BOE is expected to hold the benchmark interest rate at 0.50%. In the April decision, all 9 members voted to maintain rates, as expected. Another unanimous vote is expected in the May decision.

- Asset Purchase Facility: Thursday, 11:00. The BOE is expected to hold its QE program at GBP 375 billion. Previous votes have been unanimous and another unanimous vote is expected in the May decision.

- BOE Chief Economist Andy Haldane Speaks: Thursday, Tentative. Haldane will speak at an event in Edinburgh. A speech which is more hawkish than expected is bullish for the pound.

- Construction Output: Friday, 8:30. The indicator continues to struggle, posting three declines in the past four releases. The February reading of -0.3% fell short of the estimate of 0.0%. The markets are bracing for a sharp drop in March, with an estimate of -2.8%.

- External BOE MPC Member Martin Weale Speaks: Friday, 12:30. Weale will speak at an event in Liverpool. The markets will be looking for hints regarding the BoE’s future monetary plans.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.4443. The pair showed some strength early in the week, climbing to 1.4769. The pair then reversed directions and dropped to a low of 1.4414, as support held firm at 1.4413 (discussed last week). GBP/USD closed at the week at 1.4419.

Live chart of GBP/USD: [do action=”tradingviews” pair=”GBPUSD” interval=”60″/]

Technical lines from top to bottom

We begin with resistance at 1.4856. This line has held firm since late December.

1.4752 is next.

1.4635 has been a resistance line since early February.

1.4562 remains busy and has switched to a resistance line following sharp losses by GBP/USD.

1.4413 was a cap in January. It is a weak support line.

1.4297 is protecting the 1.43 line.

1.4148 is next.

1.4038 is the final support level for now.

I am bearish on GBP/USD.

April PMIs missed expectations, pointing to softness across the UK economy. Inflation levels remain low, and uncertainty over the Brexit referendum could weigh on cable.

In our latest podcast we examine: Markets vs. Trump vs. Clinton

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.