GBP/USD plunged 275 points last week, its sharpest weekly drop since early July. The pair closed just shy of the 1.30 level. There are just four events this week. Here is an outlook on the major market-movers and an updated technical analysis for GBP/USD.

The pound posted sharp losses after British CPI missed its estimate, with a reading of 0.6%. Retail sales contracted, but beat expectations. The BoE did not lower rates again, but did send broad hints that a November cut was a strong possibility. US numbers were mixed last week. However, CPI and jobless claims were slightly better than expected.

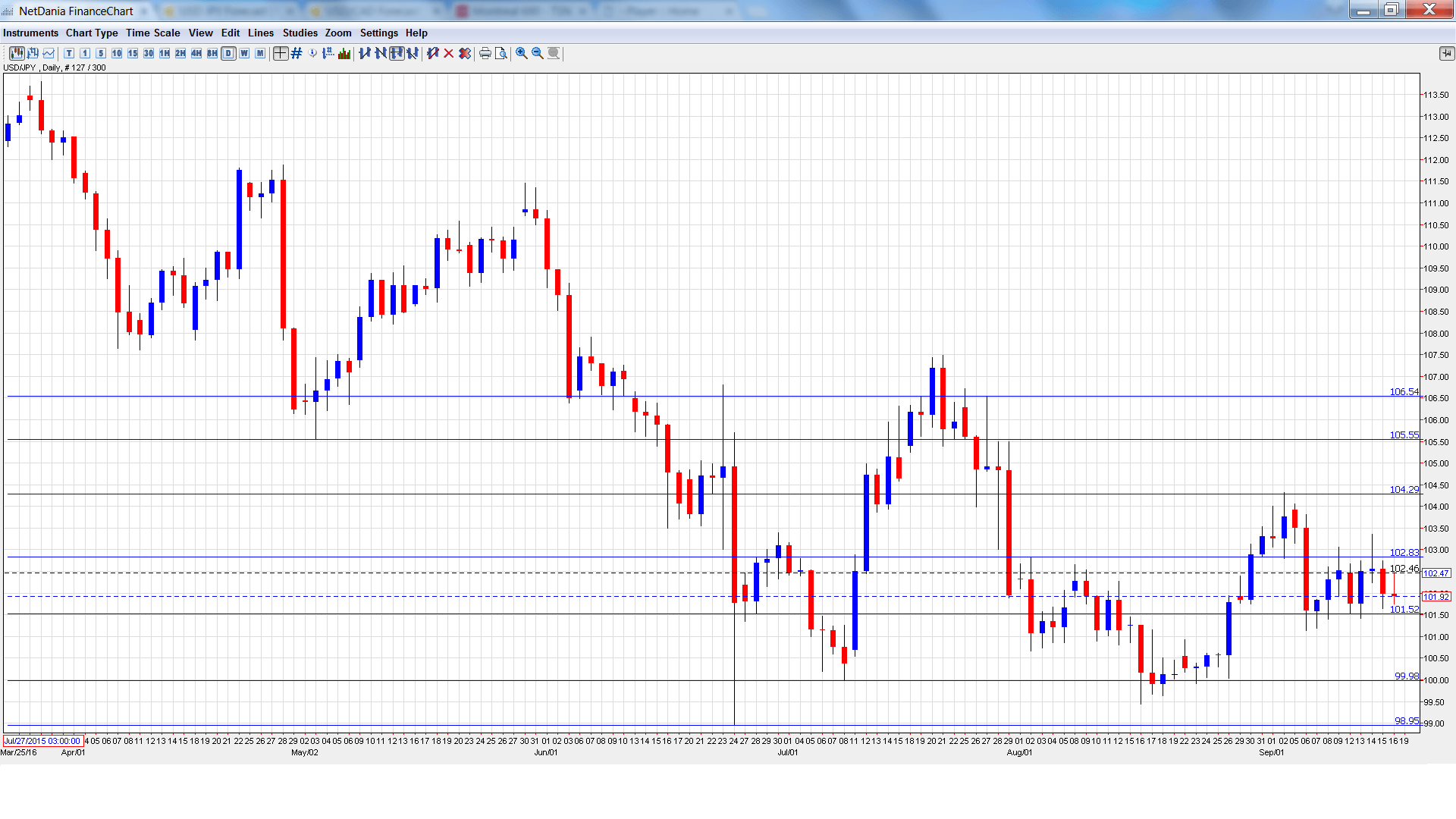

GBP/USD graph with support and resistance lines on it. Click to enlarge:

- 30-year Bond Auction: Tuesday, Tentative. The yield on 30-year bonds dipped to 2.10% in June, down from 2.35% in the previous release. Will the downward trend continue in the September auction?

- Public Sector Net Borrowing: Wednesday, 8:30. The UK posted a rare surplus in the July release, with a reading of GBP 1.5 billion. This was short of the forecast of a GBP 2.3 billion surplus. The markets are braced for a sharp downturn in the August report, with a forecast of a decline of GBP 10.5 billion.

- BoE Quarterly Bulletin: Wednesday, 11:00. This minor indicator contains market analysis and commentary on monetary policy operations. Analysts will be looking for any clues as to future monetary policy. The BoE has hinted that a November rate cut is a strong possibility.

- FPC Statement: Thursday, 8:30. The Financial Policy statement provides an analysis of the financial stability of the British banking system. The markets will be particularly interested in the economic conditions which prodded the bank to lower rates and expand the asset-purchase scheme in August.

- CBI Industrial Order Expectations: Thursday, 10:00. The indicator continues to weaken, as manufacturers remain pessimistic about market conditions. The August reading dipped to minus -5, but this was better than the forecast of minus -9. Another reading of minus -5 is expected in the September reading.

- BOE Deputy Governor Jon Cunliffe Speaks: Thursday, 13:30. Cunliffe will speak at an event in Frankfurt. A speech that is more hawkish than expected is bullish for the British pound.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.3271 and quickly touched a high of 1.3347. The pair posted sharp losses late in the week, dropping to a low of 1.2993 and breaking below support at 1.3020 (discussed last week). GBP/USD closed the week at 1.2996.

Live chart of GBP/USD:

Technical lines from top to bottom

With GBP/USD posting sharp losses, we start at lower levels:

1.3444 has been a cap in September.

1.3346 is next.

1.3219 has switched to support following the pound’s sharp decline.

1.3112 marked a low point in June as the pound crashed after the Brexit vote.

1.3020 is a weak resistance line.

1.2902 is providing support.

1.2778 was a cushion in mid-July.

1.2612 is the final support line for now.

I am bearish on GBP/USD.

UK releases have been decent in Q3, but the BoE could well lower rates again in November if the economy shows signs of weakness. In the US, a rate hike is likely coming, although the timing remains unclear. So the greenback should continue to benefit from monetary divergence.

Our latest podcast is titled Brexit: Bad, Bearable or Brilliant?

Follow us on Sticher or iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.