GBP/USD reversed directions last week, as the pair dropped 100 points. GBP/USD closed the week at 1.4121. This week’s highlights are CPI and the Official Bank Rate. Here is an outlook on the major events moving the pound and an updated technical analysis for GBP/USD.

In the US, ISM Non-Manufacturing PMI beat the estimate, and the Fed minutes were dovish, as an April rate hike appears very unlikely. In the UK, Manufacturing Production slipped 2.2%, well off expectations.

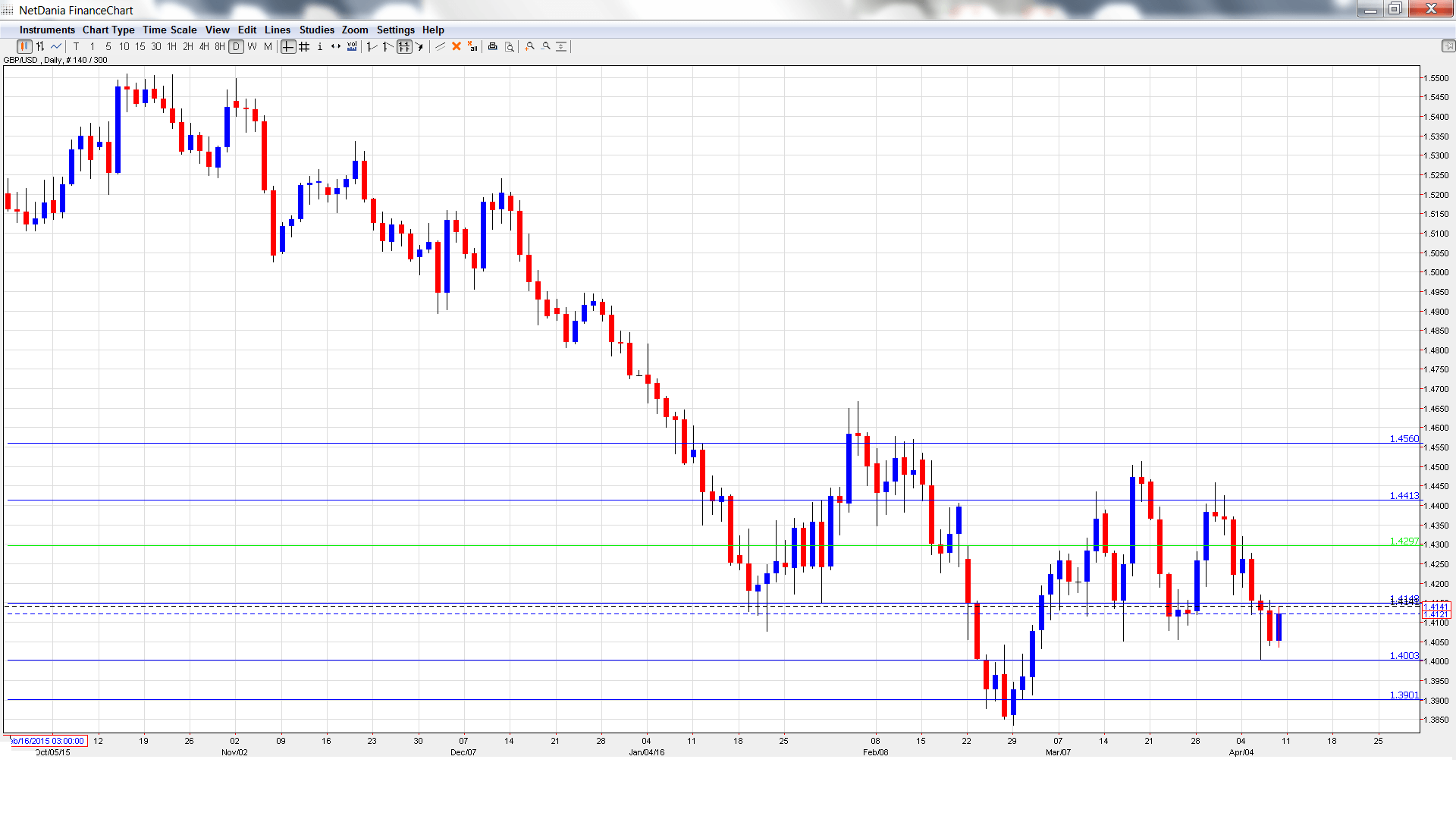

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- BRC Retail Sales Monitor: Monday, 23:01. This indicator gauges the change in sales volume in BRC shops. The indicator posted a weak gain of 0.1% in February, compared to a gain of 2.6% a month earlier.

- CPI: Tuesday, 8:30. CPI is the primary gauge of consumer inflation and should be treated as a market-mover. The index remained at 0.3% in February, shy of the estimate of 0.4%. Another gain of 0.3% is expected in the March report.

- PPI Input: Tuesday, 8:30. This manufacturing inflation index posted a small gain of 0.1% in February, breaking a streak of three straight declines. The markets are expecting better news in February, with an estimate of 0.4%.

- RPI: Tuesday, 8:30. RPI includes housing costs, which are excluded from CPI. The index posted a gain of 1.3% in February, a repeat of the January reading. A gain of 1.5% is the estimate for the March report.

- BOE Credit Conditions Survey: Wednesday, 8:30. This quarterly report provides details of credit conditions in the UK. Credit levels are closely connected with spending, an engine of economic growth.

- 30-year Bond Auction: Wednesday, Tentative. The yield on 30-year bonds dipped to 2.21% in February. Will the downturn continue in the April auction?

- CB Leading Index: Wednesday, 13:30. This indicator is base on 7 economic indicators. The index dipped to 0.2% in February, its lowest level in three months. Will we see a rebound in the March report?

- RICS House Price Balance: Wednesday, 23:01. After three straight declines, the indicator reversed directions and posted a gain of 0.7% in January. This easily beat the estimate of 0.2%. The markets are bracing for a decline in February, with an estimate of -0.1%.

- Official Bank Rate: Thursday, 11:00. The BOE is expected to hold the benchmark interest rate at 0.50%. In the March decision, all 9 members voted to maintain rates, as expected. Another unanimous vote is expected in the April decision.

- Asset Purchase Facility: Thursday, 11:00. The BOE is expected to hold its QE program at 375 billion pounds/year. Previous votes have been unanimous and no change is expected in the April decision.

- Monetary Policy Summary: Thursday, 11:00. The summary contains details of the BoE’s view of the economy. Analysts will be combing through the report for clues of future monetary policy.

- MPC Member Nemat Shafik Speaks: Thursday, 20:00. Shafik will speak at an event in Washington. A speech that is more hawkish than expected is bullish for the pound.

- Construction Output: Friday, 8:30. The indicator reversed directions in January and declined 0.2%, compared to a forecast of -1.3%. The estimate for the February release stands at 0.0%.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.4224. The pair quickly climbed to a high of 1.4321, testing resistance at 1.4297 (discussed last week). The pair then reversed directions and dropped to a low of 1.4003. GBP/USD ended the week with gains and closed at the week at 1.4121.

Live chart of GBP/USD: [do action=”tradingviews” pair=”GBPUSD” interval=”60″/]

Technical lines from top to bottom

1.4562 is providing strong resistance.

1.4413 was a cap in January.

1.4297 was tested early in the week.

1.4148 has switched to resistance following losses by the pair. The line was a cushion in late January.

The round number of 1.40 continues to provide support. It was last breached in March.

1.3901 is providing support just above the 1.39 level.

1.3809 has held firm since March 2009.

1.3678 is the final support line for now.

I am bearish on GBP/USD.

UK inflation indicators are expected to remain low, pointing to an economy with plenty of slack. With the dovish Fed minutes behind us, the markets can put rate hike speculation on the backburner and focus on US fundamentals, which have generally been strong. A well, with an uncertain global economic environment, the safe-haven US dollar remains an attractive asset for many investors.

In our latest podcast we explain why the doves do NOT cry.

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.