GBP/USD reversed directions last week and gained 100 points. The pair closed at 1.3122. This week’s key event is the official bank rate, with the BoE expected to lower rates to 0.25%. Here is an outlook on the major market-movers and an updated technical analysis for GBP/USD.

Preliminary GDP for Q2 posted a gain of 0.6%, edging above the estimate of 0.5%. Although a respectable gain, this could be the calm before the storm, as analysts expect a weak third quarter due to Bexit. In the US, the Fed was cautiously optimistic but did not provide any hints regarding the timing of a rate hike. The greenback lost ground in response to a poor GDP report: a gain of just 1.2%, well short of the estimate of 2.6%.

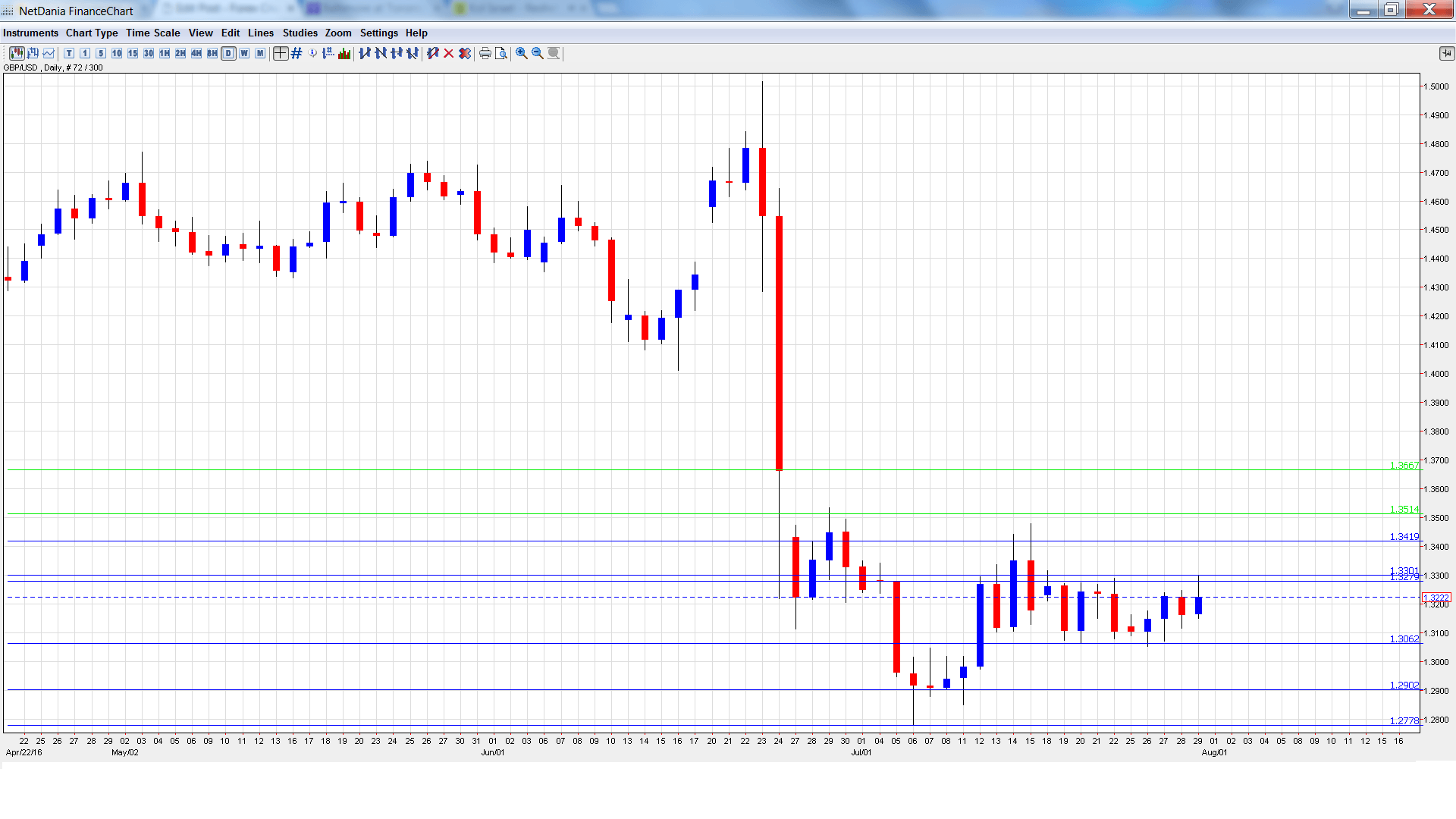

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- Manufacturing PMI: Monday, 8:30. The indicator dipped to 49.1 points in June, pointing to contraction in the manufacturing sector. No change is expected in the July release.

- Construction PMI: Monday, 8:30. The PMI dropped sharply in June, falling to 46.0 points, which was well below expectations. This marked the first decline in over three years. The downturn is expected to continue in the July release, with an estimate of 44.2 points.

- BRC Shop Price Index: Tuesday, 23:01. This consumer inflation index continues to decline, and dropped 2.0% in June. Will the index post another sharp decline in the July release?

- Services PMI: Wednesday, 8:30. Services PMI posted a sharp drop in June, falling to 47.4 points. This missed the estimate of 48.9 points. No change is expected in the upcoming release.

- BoE Inflation Report: Thursday, 11:00. This quarterly report details the BoE’s projections for inflation and economic conditions for the next two years. The upcoming report will be the first after the Brexit vote, and a negative tone could push the pound lower. BoE Governor Mark Carney will host a press conference after the release of the report.

- Official Bank Rate: Thursday. 11:00. The BoE is expected to lower the benchmark rate by a quarter point, to a historic low of 0.25%. The rate has been pegged at 0.50% since 2009, so a rate cut could push the pound to lower levels. The BoE will also release the breakdown of the July vote where the bank held the rate, which is expected be a unanimous vote (9-0).

- Asset Purchase Facility: Thursday, 11:00. The BoE’s asset-purchase program has been pegged at 375 billion since 2012, and no change is expected in the upcoming decision. The BoE will publish the breakdown of the July vote, which is expected to a unanimous vote (9-0).

- Halifax HPI: Friday, 7:30. This housing inflation indicator provides a snapshot of the level of activity in the housing sector. The indicator jumped to 1.3% in June, crushing the forecast of 0.4%. The estimate for the July report stands at -0.1%.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.3121 and touched a low of 1.3053, testing support at 1.3064 (discussed last week). The pair then reversed directions and climbed to a high of 1.3301 late in the week. GBP/USD was unable to consolidate at these levels and retracted, closing the week at 1.3222.

Live chart of GBP/USD: [do action=”tradingviews” pair=”GBPUSD” interval=”60″/]

Technical lines from top to bottom

We start with resistance at 1.3667. This line was a cushion back in March 2009.

1.3514 has held firm since late June.

1.3419 is next.

1.3276 was tested in resistance as the pair briefly pushed to the 1.33 level.

1.3142 has switched to a support role.

1.3064 is protecting the symbolic 1.30 level. It was tested in support last week.

1.2902 is next.

1.2778 is the pair’s lowest level since 1985. This is the final support level for now.

I am bearish on GBP/USD.

The BoE is expected to lower rates this week to 0.25%. Even though this move has been priced in, a rate cut will be a major event and could result in the pound losing ground.

Our latest podcast is titled A grounded chopper, slow-mo growth, and an unreliable BOE boyfriend?

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.